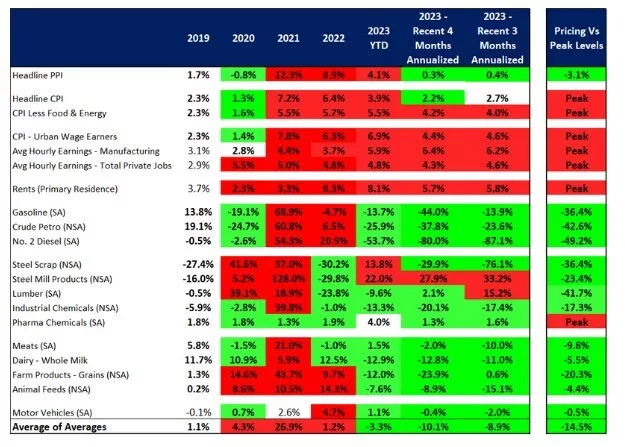

We continue to see signs that the US economy has mostly beaten inflation, and we expect to see continued good news roll in on this front in a two-steps forward, one-step backward manner. Below we see that Headline PPI over the past four months is annualized at only +0.3% YOY, while Headline CPI over the past four months is annualized at +2.2% YOY. CPI excluding more volatile food & energy is tracking +4.2% YOY over the past four months. Labor (+4%-6% YOY over the past four months annualized) and primary residence rents (+5.7% YOY over the past four months annualized) are the primary sources of ‘sticky inflation’ that remain today. We are seeing disinflation in many raw materials and goods, with prices down from peak levels by ~40% in energy, ~25% in construction materials like lumber and steel, and down by 5%-10% in grocery items like dairy and meats. While the below table was mostly red in 2021-2022 (inflation greater than 3.5%), it is now showing significantly more green (inflation less than 2.0%). Overall, we are pleased with the much lower prices seen over the past 3-4 months (which we annualized) and believe this indicates that inflation will continue its march down to a much healthier 3% overall inflation level through year-end.

Figure 1. Various Measures of Inflation Show the Beast Being Tamed

Source: Avid Realty Partners

Despite this good news and signs of disinflation in many items assessed above, the Fed is likely to remain hawkish and raise rates in July.

Despite the good news seen in the data above, the Federal Reserve will likely remain hawkish and raise rates at its upcoming July meeting, if for nothing else, then to save face and make a point about just how much they are against inflation. As we discussed one week ago, the job market remains strong overall, it is still the primary source of ‘sticky inflation’ filtering into the rest of the US economy, and the Fed’s substantial efforts to tame inflation with 10 rate hikes since early 2022 (and an 11th coming in July) have not sufficiently slowed the US economy to tame inflation in all metrics fully. So, we do expect at least one and probably two more Fed rate hikes this summer and fall, and for rates to stay higher longer than we expected 3-6 months ago so the Fed can really really drive home its point and work to save its reputation.

Revisiting the Root Causes of Inflation: Excessive Quantitative Easing and too much Government Stimulus (vote buying) money.

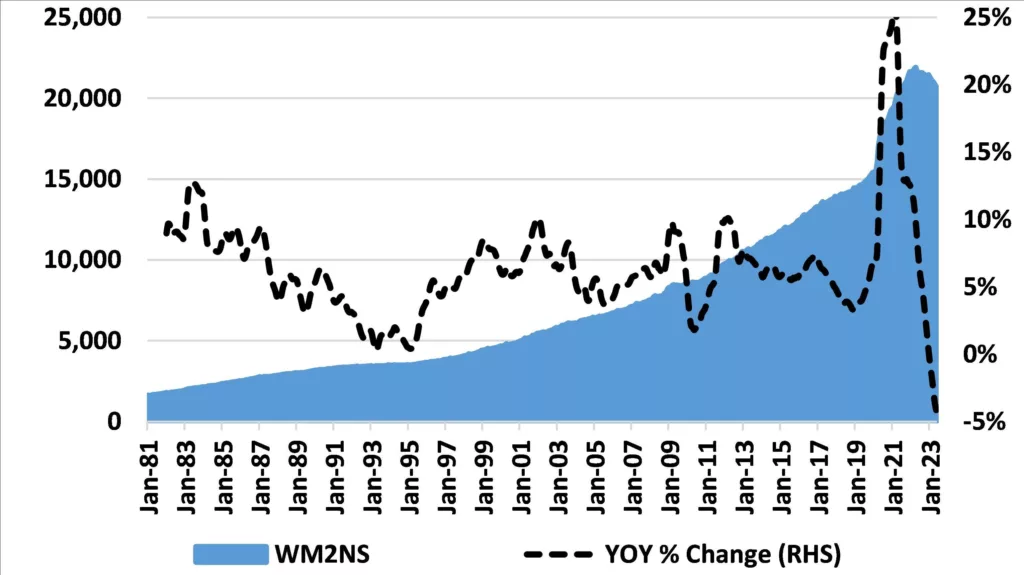

We believe that 70%-80% of the root cause of inflation was due to the Federal Reserve’s out-of-control Frankenstein experiment known as Quantitative Easing (QE). As shown below, the Fed egregiously grew the US’ M2 Money Supply by 43% from the onset of Covid in February 2020 through early 2022. That is 43% growth in US M2 Money Supply in 23 months!! Well, it is no wonder we have had 43% inflation over the past few years!! Other causes of inflation include repeated Federal & State Government stimulus programs, including many that were not needed, and more affluent people that did not need the funds (some twisted form of politician-driven voter appeasement or vote buying). We think that supply chain bottlenecks accounted for less than 10% of the overall cause of inflation and the Russia/Ukraine war less than 2% of the overall cause of inflation.

M2 Money Supply is the monetary tail wagging the inflation dog.

The below graph shows a couple of things: 1) The growth in M2 Money Supply has been out of control and is now falling back into normal year-over-year growth levels with Quantitative Tightening; 2) #TheFed probably needs to shrink its balance sheet and overall M2 Money Supply, not just prevent it from growing further…only then will the US Dollar recover some of its buying power (despite strength versus other international currencies, which are in even worse shape than the US Dollar); and 3) The last time growth in M2 Money Supply was over 10% was in the early-to-mid 1970s (through 1977), which spurred its own inflation nightmare in the late 1970s and early 1980s.

Figure 2. Growth in M2 Money Supply the Primary Cause of Inflation…QE The Fed’s Frankenstein Baby

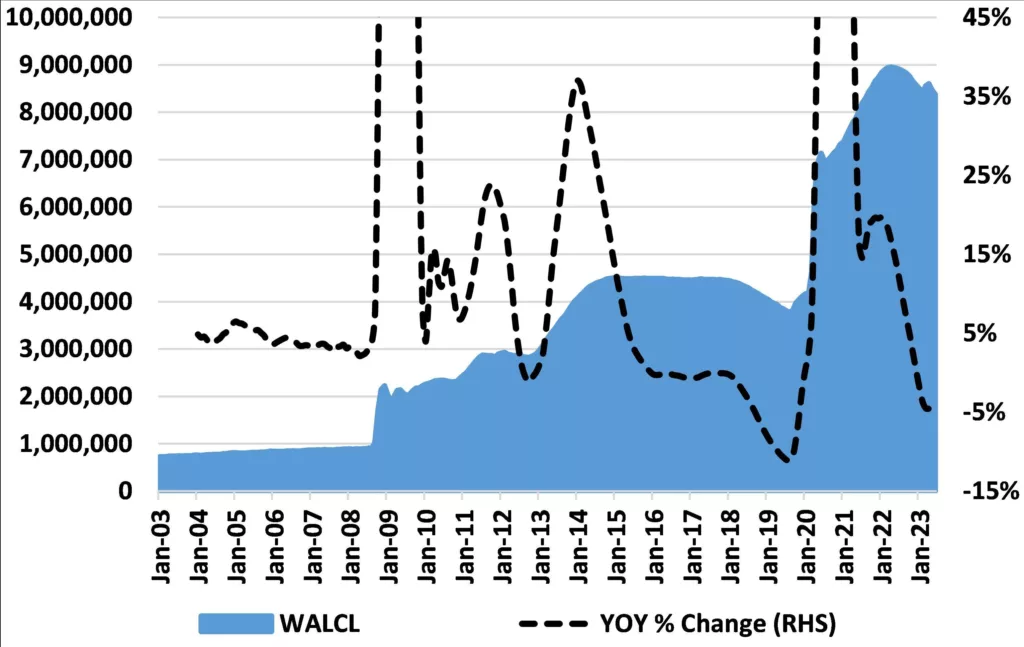

Figure 3. The Fed’s Balance Sheet Grew Recklessly Fast and Has Fallen Just 6.5% From Peak Levels of April 2022

As we move forward, what should we expect?

Stick with us as we delve deeper into these patterns, shedding light on the complexities of these economic trends. Citing leading economists and subject matter experts, we’ll unpack why we should expect inflation to continue its march down to healthier 3% overall levels by the year’s end. Prepare to embark on a journey of economic discovery, revealing the resilience and adaptability of the U.S. economy. Will the trend continue? Stay tuned.

Navigating the Economic Tide: Fortifying Your Real Estate Strategy Amid Inflation Fluctuations

In the face of an evolving economic landscape, the path toward successful real estate investing becomes even more critical. Our deep dive into the mechanisms behind inflation, the responses of the Federal Reserve, and the role of quantitative easing have shown how these dynamics affect the U.S. economy. As we observe the steady march towards healthier inflation rates and a stronger economy, your real estate investing strategies should adapt and thrive accordingly.

We at Avid Realty Partners understand the complexities of these economic indicators and trends and how they directly impact your real estate investing journey. That’s why we encourage you to book a free strategy call with us. Together, we can navigate the nuances of these fiscal developments, fine-tune your investment strategy, and empower you to make the most out of the forthcoming economic opportunities.

Don’t miss this opportunity to stay ahead in the rapidly shifting real estate investment landscape and equip yourself with the knowledge and strategy to tackle the economic uncertainties of today and harness the potential rewards of tomorrow. The journey toward your real estate success starts here.

Leave A Comment