The 2024 Economic and Multifamily Outlook projects to be an exciting year of politics and economic progress and full of tremendous real estate buying opportunities. We think that 2024 is shaping up to be an exciting year with Presidential and Congressional politics taking up a lot of peoples’ attention, with a broad economic recovery advancing in a lower interest rate environment, and with these dynamics creating a very compelling buying opportunity in Real Estate.

Before we deep dive into the future, let’s take a quick look at our predictions from one year ago.

2023 was, by all accounts, a transition year, one that many spent on the sidelines awaiting better buying opportunities and more economic certainty. Looking back at our 2023 outlook piece from one year ago, we got a number of things right and a handful of things wrong. Overall, we are grading ourselves at a 3.5 out of a possible score of 6, including the following:

- Correct: The inflation fight is mostly won, falling to 3%-4% by the end of 2023. We pretty much nailed this one even though many strongly disagreed with us when we wrote this one year ago. Indeed, we are starting to see disinflation in some food and other everyday household items, likely leading The Fed to be much more aggressive about protecting its ‘soft-landing’ scenario;

- Incorrect: 10-Year Treasury would exit 2023 at 2.5%-3.0%. With the 10-year Treasury currently trading at 3.9%, we got this one wrong. We think 2.5%-3.0% is in the cards one year from now, exiting 2024, but we were early with this call one year ago.

- Mostly Correct: The Economy will Weaken throughout 2023 and head into a modest recession. This seems like a mostly correct assessment overall, but we can argue over the minutiae. Overall, the economy seems like it did weaken in 2023 across Job Growth, Consumer Spending, and other metrics. We also think the economy is in a modest recession, especially when adjusting for inflation, and is ‘teetering.’ That said, The Fed has likely pulled off its ‘soft-landing’ scenario, and we do not expect a sharp recession or crash in 2024.

- Incorrect: Stock Market decline is mostly behind us, but another 10%-15% downside remains. We got this one wrong. It seems the stock market indices bottomed in September 2022 or October 2022. While it was correct that most of the downside was behind us one year ago, it was not correct that more downside remains. Indeed, the stock market is up substantially off of its lows of Sep-Oct 2022, with the S&P 500 up 36% from its lows and the NASDAQ up 46% from its lows…wow!

- Correct: Multifamily Apartment fundamentals were worsening with more downside to Occupancy and Rate. We got this one correct, and apartment fundamentals remain squishy today, both due to substantial apartment market supply, a weak overall macroeconomic environment, and renters that are stretched to their limits due to inflation.

- Correct: Financing distress and over-priced deals purchased with bridge debt are driving falling multifamily prices and the availability of more great deals. We have seen real estate and multifamily prices come down meaningfully in 2023 due to higher interest rates, some financing distress, and because so many investors were on the sidelines, not buying deals. With very limited capital to put to work, pricing has come down meaningfully, creating much lower prices and the availability of some great deals.

Now, without further ado, Avid Realty Partners’ Top 10 List of the forces that will shape the 2024 overall environment:

- Presidential and Congressional politics will remain highly partisan and nasty and will suck up much of the oxygen in the room this year. Unfortunately, we expect that the 2024 Presidential and Congressional campaign cycle will remain highly partisan and nasty. We think it’s time that America’s leaders get back to a more dignified and civil tone, putting the country’s needs first. With a Biden-Trump rematch likely (unfortunately) and a highly contested Senate hanging in the balance, we expect this will be the most expensive and ugly political cycle ever, taking up a lot of peoples’ attention and sucking the oxygen right out of the room. Despite this nastiness, we still think America’s political system works and its checks and balances will even things out over time.

- The Fed will cut rates by 100-125 bps to aid in a ‘soft-landing’ scenario, with the 10-Year Treasury exiting 2024 at 2.75%-3.25%. We think The Fed will cut rates by a total of 100-125 bps in 2024 to aid in the economy’s ‘soft-landing’, and to stay ‘neutral’ in the upcoming Presidential election. While the Fed telegraphed three likely cuts in 2024, we think some of those cuts will be 50bps. In general, we think the 10-Year Treasury trades in a ‘normal’ range of 1.7%-3.0%, as it did from 2011-2019, a time period that is BC (before Covid), but after the Great Financial Crisis. Furthermore, we believe Uncle Sam is effectively broke with total federal debt to GDP now at 124% versus only 30% in 1980, a QUADRUPLING of the USA’s relative debt over the past 43 years! Given this, we do not think Uncle Sam can afford to pay 5% treasury rates anymore, or even 4% treasury rates, and will ‘coordinate’ with other high-interest paying countries (Canada, Australia, UK, France) to lower global AAA-rated paper towards 2.5% over the coming quarters. In short, we expect lower interest rates from The Fed to filter down to market interest rates, some of which are already reflected in now-lower Treasury Rates;

- Inflation will mostly be beaten back, but pressures will remain on wages, energy, farm products, and possibly rents. We think that the inflation battle has mostly been won already and will be won more fully in the coming months and quarters, with victory declared by 2H’24 (ahead of the Presidential election, of course). We do expect ongoing pressures in wages, with peoples’ raises delayed relative to the immediate repricing of goods throughout the rest of the economy. We expect there could be ongoing inflation pressures in the energy sector as many political leaders attempt a more aggressive cutover to ‘clean and sustainable’ non-carbon-based energy sources. We expect the takeover of the family farm by private equity shops and other institutional investors will continue to drive some inflationary pressures in farm products. Finally, we think that substantial cost increases in housing-related insurance, maintenance expenses, labor, property taxes, and others will cause rents to continue to climb, though this factor will be somewhat offset in the near term by substantial deliveries of new multifamily apartment supplies. Net net, we think the overall inflation battle has been won and that The Fed’s efforts to shrink its balance sheet via QT will have the intended consequences of keeping inflation low for the foreseeable future.

- The stock market will grind higher, though many gains are already behind us. As noted, the US stock market indices are already well off their recent lows of September 2022, with the S&P 500 up 36% off its bottom and the NASDAQ up a whopping 46% off its bottom. But, with The Fed announcing that it will be cutting rates multiple times in 2024, with a ‘soft-landing’ economic scenario increasingly likely, and with inflation mostly beat back at this point, we think the stock market is poised to run higher in two-step forward and one-step backward fashion.

- Institutional Investors will slowly get off the sidelines and re-enter the investment markets. With interest rates lower (already), the stock market rallying meaningfully, and a ‘soft-landing’ economic scenario increasingly likely, we think broad-based investor redemptions will wane, and more institutional investors will slowly get off the sidelines. We do think transaction volumes will increase given that there is less uncertainty in the economy and interest rates than there was just one year ago and that the world will return to a more normal working environment. With so many institutional investors ‘on the beach’ in 2023, transaction volumes were low, prices were low, and there was limited demand for new investments. We expect these factors to transition to a more normal capital markets environment in 2024.

- Many investors purchased over-priced multifamily in 2021 and 2022, and those with limited balance sheets and deals with bridge debt will feel the pain. Yes, many multifamily buyers purchased over-priced multifamily deals in 2H’20 – 1H’22 when cheap money was as plentiful as air. In fact, nearly anyone who purchased a deal in 2021 or early 2022 overpaid for the deal! Those firms with limited balance sheets, who were overly aggressive in purchasing deals, and those with a plethora of highly leveraged bridge debt deals will feel significant pain (if they aren’t already) as interest rate caps expire and ‘cash-in’ refinances become the norm. Some of these buyers may use Pref Equity to kick the can down the road (Pretend and Extend) until multifamily prices are at higher levels, but many smaller firms will not make it that far. In short, there is financing distress, bridge debt-related distress, and interest rate cap-related distress, and many of these issues will come to a head in 2024, resulting in a large supply of lower-quality deals available at lower prices.

- Distressed debt deals and Pref Equity will see the most activity in 2024, but plain vanilla investment opportunities will make a comeback, too. We sort of reference this in the prior point, but most institutional investors want ‘distressed deals’ at very, VERY attractive prices, or they want to put Pref Equity to work where they have very little or no risk with their investment dollars. We have seen this already in 2023 and expect to see a continuation of this trend in 2024. After all, if one has cash on hand today, then now is the time to press one’s advantage. Despite these dynamics, we think ‘plain vanilla’ deals that are high quality in nature will be increasingly en-vogue as normal institutional investors get back to the business of buying quality assets at attractive prices, even if they are not ‘distressed’ deals.

- Multifamily supply will continue to deliver at a meaningful rate, especially in 1H’24, creating a unique opportunity to buy attractively-priced new construction core-plus multifamily deals. There has been a LOT of multifamily supply that has been delivered in 2023, and we expect a LOT more to deliver in 2024, particularly in 1H’24. Projects that are mid-construction will, by and large, deliver as expected, particularly in the multifamily apartment sector. In fact, multifamily supply deliveries are at 50-year highs, levels not seen since the early 1970s! We believe this is creating one of the most unique and attractive opportunities to purchase brand new construction core-plus multifamily deals at or below cost and that acquisitions at today’s prices will look very smart three to five years from now in hindsight. Indeed, this is one of Avid Realty Partners’ core focus areas for 2024.

- Increased multifamily supply will continue to pressure Occupancy, Rental Rates, and overall financials, while insurance and inflation-driven expenses will compress the bottom line, thus leading to overall asset price rationalization. The above-referenced supply boom has pressured occupancy rates, rental rates, and concessions in 2023, and this will continue to be the case in 2024 as this supply is absorbed and digested. Beyond this, very large cost increases in insurance, property taxes, payroll, maintenance expenses, and everything else – thanks to inflation and heightened weather events – are squeezing multifamily investors from both the top line and bottom lines and shrinking overall property-level net operating incomes.

- Multifamily prices will find a bottom, with higher transaction volumes versus 2023, creating a compelling buying opportunity ahead of growth in 2025-2027. As referenced above, the compression in net operating income metrics from revenues and expenses is meaningfully contributing to a reset in property prices. The lack of institutional equity (limited demand to purchase multifamily properties) is also contributing to a reset in property prices. We believe this reset in prices is substantially behind us at this point, but more property owners/sellers may come to terms with the lower market pricing in 2024 and become market sellers (sometimes due to death, divorce, disease, etc.). Indeed, we expect these factors to contribute to higher transaction volumes. Overall, we expect multifamily prices are now bottoming, inflation has peaked, interest rates have peaked, institutional investors are re-entering the investment market, and NOW is a tremendous and unique opportunity to purchase high quality apartment deals at very attractive prices.

Inflation Status Check: Much Progress Made, a Bit More Work to be Done

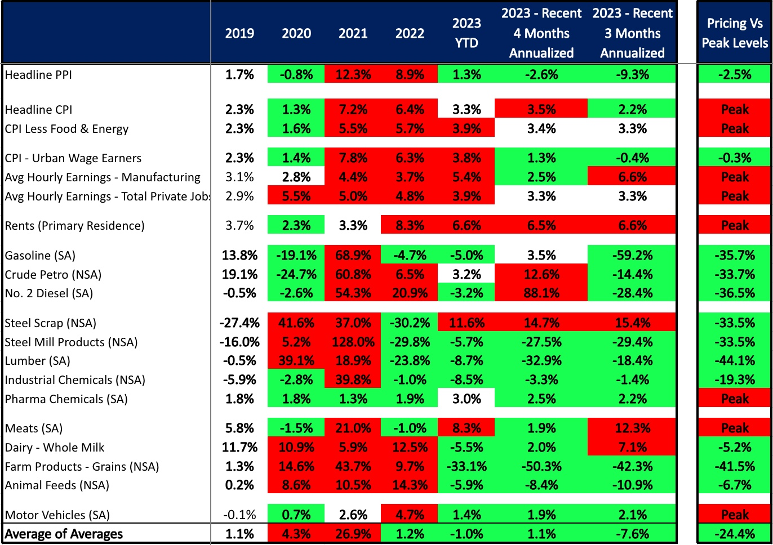

Inflation numbers look good, with only Wages, Rents, and Energy still at elevated levels. Inflation data continues to trend positively in a two-step forward, one-step backward fashion. Indeed, we really only see elevated inflation levels in Wages (3.8% – 5.4% growth YTD), Rents (+6.5% growth YTD), some energy metrics, and some food/farm products. We see that Headline PPI is only up 1.3% YTD, while CPI is up 3.3% to 3.9% YTD. These numbers really are not that bad! This leads us to believe that the battle against inflation, which is delayed relative to the timing of Fed rate hikes, has largely been won, and it is time to prepare, via FedFunds rate cuts, for the soft-landing that The Fed needs to save face and repair its legacy.

Figure 1. Various Inflation Metrics: Mostly Normal Readings with Wages and Rents Still High

Source: Avid Realty Partners

Oil is still a risk to go-forward inflation. President Biden’s decision to drain the Strategic Petroleum Reserve throughout much of 2022 (from ~650 million barrels of oil to ~350 million barrels of oil today) and the administration’s desire to aggressively cutover to ‘clean and sustainable energy’ are risks to energy-driven inflation measures. Higher (or potentially much higher) energy prices remain a primary inflation risk going forward. We think the President’s short-sighted actions were damaging to the USA, our ability to confront our energy adversaries, and our ability to fight this inflation malaise. This strategic blunder (pun intended) has been heightened by the administration’s decision to cancel a slew of Alaska oil drilling permits. This puts the USA’s energy independence in a tenuous position and increases the risk that gas will run to $5 per barrel in coming quarters.

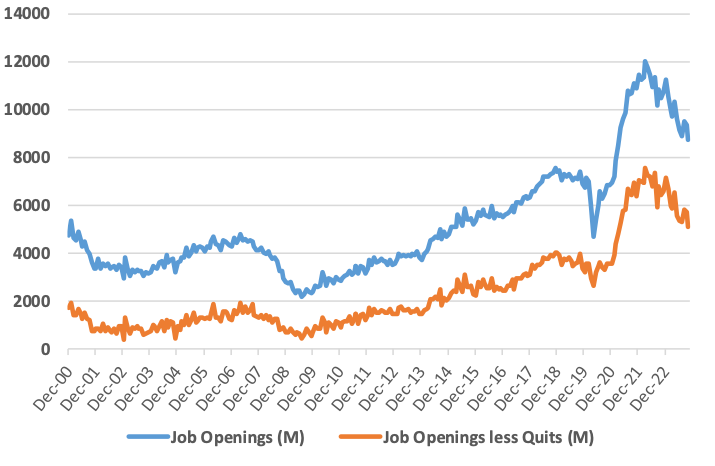

The jobs market and wages have cooled modestly but remain resilient overall, not helping the inflation fight. Inflation readings on Labor and Wages have cooled a bit over the past few months, a plus, but they are still running hotter than targeted levels given the delayed impact of annual raises and a still relatively tight labor market. The jobs market has weakened somewhat since peaking in early 2022, with Job Openings down 27.4% from peak levels, a plus for the cooling of the economy and the fight against inflation (where good news is bad news and bad news is good news), but there remains relative strength in the jobs market 21 months into the Fed’s efforts to cool the economy. Remaining strength in the jobs market likely supports a ‘soft landing’ scenario, though many will feel this economy is ‘bumpy’ nonetheless.

Figure 2. Labor Market Strength Supports Soft Landing Scenario

Source: Avid Realty Partners and fred.stlouisfed.org

Fed’s inflation target of 2% may or may not be achievable. We do think we have largely won the battle against inflation, more or less. That said, the economy may not get to the Fed’s 2% targeted inflation levels; we may not even want it to, by the way, and inflation may remain in the 2.5%-3.0% range for some time to come. Overall, we see some of the data (Wages, Rent, Energy, farm goods) presenting some ongoing risks in the fight against inflation, with a continuing reduction in M2 money supply, Fed balance sheet assets, and overall government spending levels necessary to really ‘win’ this fight. As real estate investors operating during a credit contraction cycle, we are hunkering down for the long haul should it prove to be necessary.

Revisiting the Root Causes of Inflation

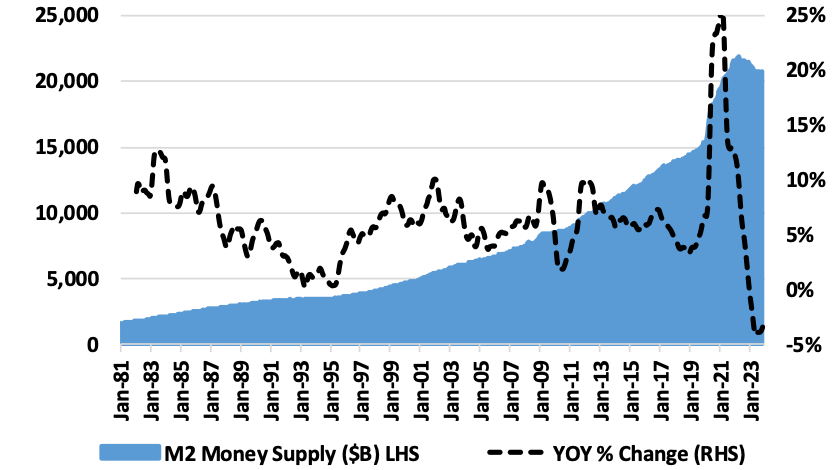

Excessive Quantitative Easing and too much Government Stimulus (vote buying) money. We believe that 70%-80% of the root cause of inflation was due to the Federal Reserve’s out-of-control Frankenstein experiment known as Quantitative Easing (QE). As shown below, The Fed egregiously grew the US’ M2 Money Supply by 43% from the onset of Covid in February 2020 through early 2022. That is 43% growth in the US M2 Money Supply in 23 months! Well, it is no wonder we have had 43% inflation over the past few years!! Other causes of inflation include repeated Federal and state Government stimulus programs, including many that were not needed, and more affluent people who did not need the funds (some twisted form of politician-driven voter appeasement or vote buying). We think supply chain bottlenecks accounted for less than 10% of the overall cause of inflation, and the Russia/Ukraine war was less than 2% of the overall cause of inflation.

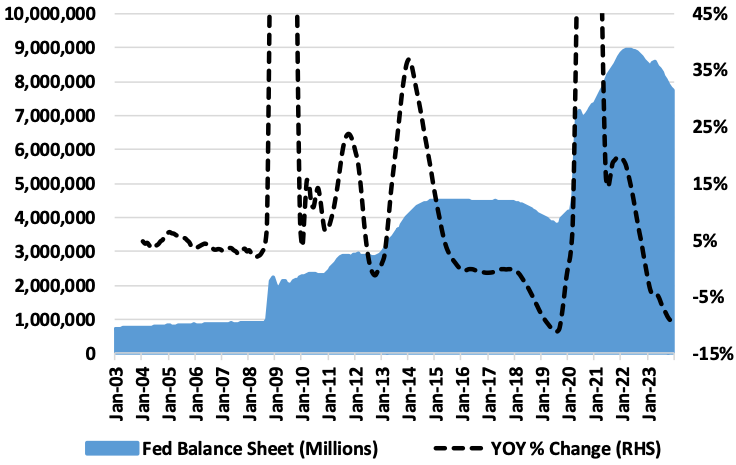

M2 Money Supply and the Federal Reserve’s Balance Sheet are the monetary tails wagging the inflation dog. Did you know that the Federal Reserve grew M2 Money Supply by a reckless 7.75% annually for 15 years running from July 2007 to July 2022? Wow, those Fed Governors should not only be fired but prosecuted for Treason! The below graph shows a couple of things: 1) Growth in M2 Money Supply has been out of control and has now fallen below historically normal year-over-year growth levels with Quantitative Tightening as the Fed works to undo some of the damage it has done; 2) #TheFed probably needs to shrink its balance sheet and overall M2 Money Supply aggressively, not just prevent it from growing further if it truly wants to get inflation under 2% target levels; and 3) The last time growth in M2 Money Supply was over 10% was in the early-to-mid 1970s (through 1977), which spurred its own inflation nightmare in the late 1970s and early 1980s. We note that the Fed has shrunk M2 Money Supply by a somewhat paltry 5.3% since its peak in Apr’22 and has shrunk its overall Balance Sheet by a still-paltry 13.6% since its peak in Apr’22. This is a reduction of $1.21 Trillion in Fed Assets from peak levels, which is a paltry sum considering Congress and the President give those sums away to affluent voters who did not need it, undocumented immigrants, student loan borrowers, the war effort in Ukraine, and others with the strike of a pen… The Fed needs to do more, and Congress must reign in these spending mishaps!

Figure 3. Growth in M2 Money Supply. The Cause of Inflation QE – The Fed’s Frankenstein Baby

Source: Avid Realty Partners and fred.stlouisfed.org

Figure 4. The Fed’s Balance Sheet Grew Recklessly Fast; Has Fallen 13.6% From Peak of Apr’22

Source: Avid Realty Partners and fred.stlouisfed.org

Interest Rates Likely Going Lower with a ‘New Normal’ of 1.7% – 3.0% Range

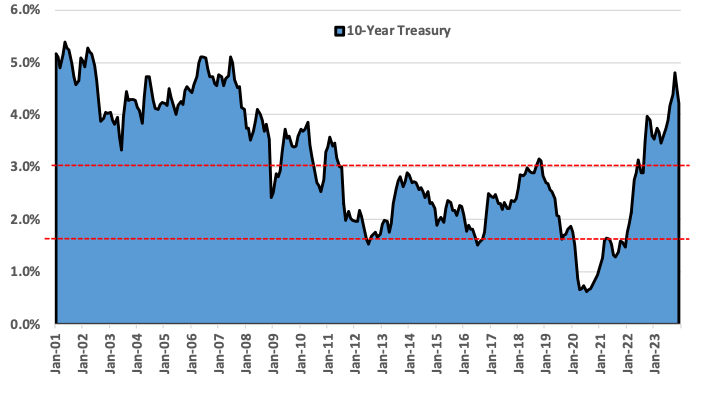

So, where are interest rates going? We think lower. As seen below, 10-year Treasury Bonds have traded between 0.6% and 5.3% over the past 21 years. Yes, we know that Treasury Bonds traded at much higher rates in the 1970s-1990s, however, we believe structural changes to the global fiscal and economic system means that society is not going back to those rates any time soon. During the past 21 years, we believe the years from 2012 to 2019 represent ‘the new normal’ in Treasury Bond pricing, with normalized yields ranging between 1.7% – 3.0%. We think these rates are what Uncle Sam can afford given the USA’s growing annual deficits and mounting fiscal debt from entitlements and general over-spending. While the USA’s fiscal and monetary policies and positions are not buttoned up, this country is still one of the best houses on a bad block, leaving global investors few choices of better investment alternatives than low-risk US Treasuries. So, in short, we think 10-year Treasury Bonds are going to trade higher, resulting in yields that trend in this 1.7% – 3.0% in coming years. We believe this range is ‘the new normal’ that will come into effect once we put this inflation debacle further in the rearview mirror.

Figure 5. Treasury Rates Should Now Trade in a ‘New Normal’ Range of 1.7% – 3.0%

Source: Avid Realty Partners and fred.stlouisfed.org

What does this mean for real estate and multifamily trends? Normalized cap rates will trend flat to down. We believe that Treasury Bond rates set the cost of Fannie Mae and Freddie Mac agency borrowing rates, which in turn help set the cap rates that multifamily deals trade at. So, we think that Multifamily agency borrowing rates are 180bps-200bps higher than 10-Year Treasury Bond rates, which equates to a normalized borrowing rate of 3.5% – 5.0%, with a likely normalized agency borrowing rate in coming years of around 4.3%, give or take. Generally, we think institutional quality multifamily deals trade in a cap-rate range of Agency borrowing rates +/- 50 bps.

This means institutional quality multifamily deals will trade in a cap rate range of 4.0% – 4.8% in the coming years. Too many investors are underwriting a 6.0% exit cap rate, which we think is too high for quality products. If multifamily owners can grow their yield on the total cost to 6.5%-7.0% on a five-year hold deal and then sell near a 4.5% exit cap rate, then we think these deals will be an absolute home run in retrospect. We continue to think that multifamily prices will go up over the long term, buoyed by rising construction costs and growing rental rates and that buying quality deals at a good price during periods of volatility and price contraction (like what we are seeing today), will lead to above average returns over time.

Uncle Sam’s Finances are a Mess, and Politicians Must Act Decisively and Bravely

The Bond Markets told us something, and our elected political leaders should listen. The Treasury Market’s recent climb to 5.0% rates was telling us something, and for the sake of our country and our children’s futures, I hope US politicians in Washington, DC, listen. What is the bond market saying? Well, it’s hard to say exactly, but it feels like the message is something like this: “The United States’ financial house is in disarray, with increasing risk premiums, and decreasing confidence in the future viability of our nation and its currency”. Here are some of the reasons why this is the likely message:

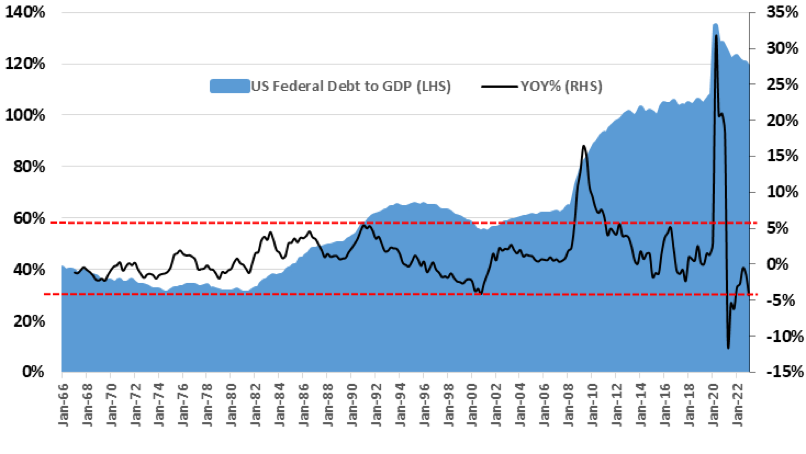

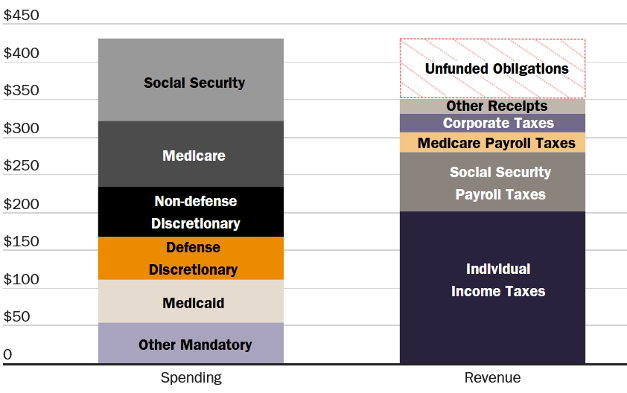

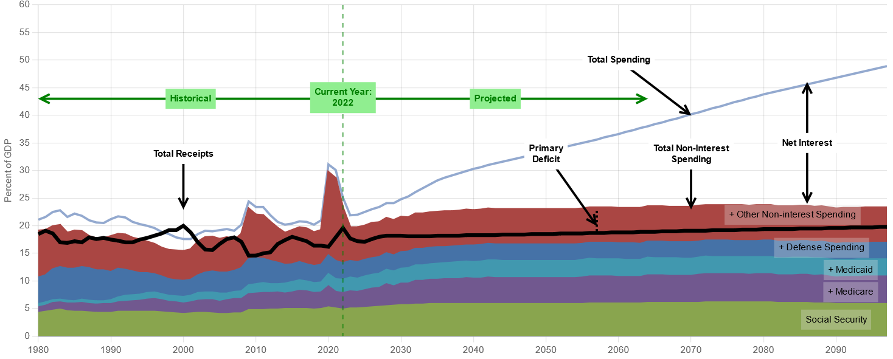

First, US Federal Debt-to-GDP Ratios are insanely high and likely going higher. Yes, the United States US Federal Debt is sky-high, and on a debt-to-GDP basis, it is at historically dangerous levels. Currently, the US has about $31.5 Trillion of US Federal Debt or about $93,000 for every person in the country. This equates to 120% of annual Gross Domestic Product (GDP), down slightly from peak levels seen during Covid but up from only 30% of GDP just 40 years ago in the early 1980s. As if these figures weren’t scary enough, the US has an additional $80 Trillion in unfunded Social Security and Medicare obligations over the next 75 years in present-value dollars! The Financial Report of the US Government forecasts that total US Federal Debt-to-GDP ratios will rise to 200% by 2046 and to 566% by 2097…wow! This report suggests that by 2050 (just 27 short years from now), the US Federal Government’s debt service will total 10% of annual GDP, which is insanity. No government in the history of mankind has ever recovered from these mountainous levels of debt. When will our elected ‘Leaders’ take notice and respond in kind by cutting spending, right-sizing federal program activities, stopping the endless free-money giveaways, balancing our Federal budget, and funding Social Security and Medicare obligations? It could take a financial crisis to get anyone to listen, and by then, it could be too late.

Figure 6. US Federal Debt-to-GDP Ratios are Dangerously High

Source: Avid Realty Partners and fred.stlouisfed.org

Figure 7. Unfunded US Government Obligations Will Total $80 Trillion Over 75 Years

Note: The graph displays total projected non-interest spending and revenue in 2022 present value terms.

Source: Cato.org and Dept of Treasury, “The 2022 Financial Report of the U.S. Government,” 03-24-23

Figure 8. Fed Govt Hasn’t Run a Surplus Since 2001; Debt Service Forecast at 10% of GDP in 2050

Source: Dept of Treasury, “The 2022 Financial Report of the U.S. Government,” 03-24-23

Second, Growth in Money Supply has caused inflation, impaired the value of the US Dollar, and put the US Dollar’s status as the World’s Reserve Currency at risk. The US enjoys the benefits of having our currency – The US Dollar – serve as the world’s reserve currency. We get to trade goods internationally in dollars, we enjoy a lower cost of capital by selling US Treasuries more easily (thereby financing our endless government spending deficits), and we enjoy cheaper imports and slightly more expensive exports. Also, commodities, including oil and many others, trade on the international markets in US dollar-denominated transactions. This makes it easier for US businesses to conduct operations. The US Dollar’s status as a reserve currency is because of the safety, reliability, and dependability of the US financial system and the overall strength of the system. But, with so much growing Federal Debt, political instability, and the chaos of each passing Debt Ceiling battle, the safety and reliability of this system gets called into question. These factors serve to substantially increase doubt about the dependability of the US financial ecosystem, and these issues could ultimately risk the US Dollar’s status as the world’s reserve currency. The Federal Reserve’s growth in MS money supply during Covid, and outside of the Covid pandemic, caused inflation to spike and made the US Dollar worth much less. The Fed’s QE Frankenstein experiment stabilized the economy during the peak of the crisis but had major negative impacts on inflation and, quite frankly, was reckless. The Fed, along with the actions of our elected leaders, is putting the US Dollar’s status as a reserve currency at risk and could drive the next financial crisis to be much worse for everyday Americans.

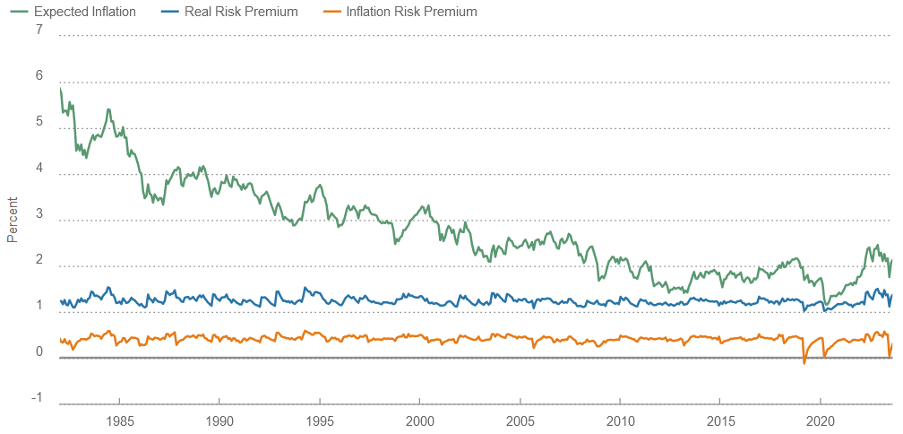

Third, the US Risk Premium is higher because of these issues, and that is pricing into US Treasuries. Yes, due to the aforementioned issues and the lack of real leadership from The Federal Reserve and from our elected officials, Treasury markets have to offer investors more return to get them to invest in US Treasuries. Simply put, the US Risk Premium is increasing, and while it has bounced meaningfully off of Covid-pandemic lows, it could go even higher still.

Figure 9. US Bond Risk Premiums are Up Off the Lows, But Could Still Go Higher

Source: ClevelandFed.org

So, what does all this mean for the Multifamily Apartment investment market? This is a lot of data to digest! We still feel that the multifamily apartment sector is ‘essential’ and that people will always need someplace to live. Even if the US Federal Government goes belly up someday in the future, people will still need homes and apartments.

A few other thoughts:

- With its hugely increasing debt load and interest payments, the US Government cannot continue to offer 4.5% – 5.0% interest rates on US Treasuries without breaking the bank and causing debt service payments to skyrocket. We think Treasury rates have to come down to lower levels.

- With lower relative yields and more political and financial instability here at home, there could be fewer countries willing to buy US Treasury debt. This could force the government to right-size its spending and/or cut Social Security and Medicare entitlement benefits.

- If the Federal Reserve or political leaders try to ‘inflate our way out’ of the growing fiscal calamity the country is in, those who own hard assets like apartment properties will see the value of those assets rise in lockstep with inflation.

- We cannot control these things, so we continue to buy the best quality and location multifamily assets at a fair price or lesser quality assets at a great price, with a strong focus on property-level and corporate-level execution. After all, everyone needs someplace to live, and we intend to be a part of the housing ecosystem for decades to come.

Thank you for reading, and Happy 2024! Please Contact Us to let us know if you have any questions or thoughts.

Love the graph showing unfunded US Government debt obligations! US politicians really need a wake up call in regards to our levels of government debt.

Overall this is a great article. No one has a crystal ball and kudo’s to those that try to predict. Almost halfway into 2024, sadly, it looks like rate cuts may not be as robust as the article says. There is always next year. 🙂