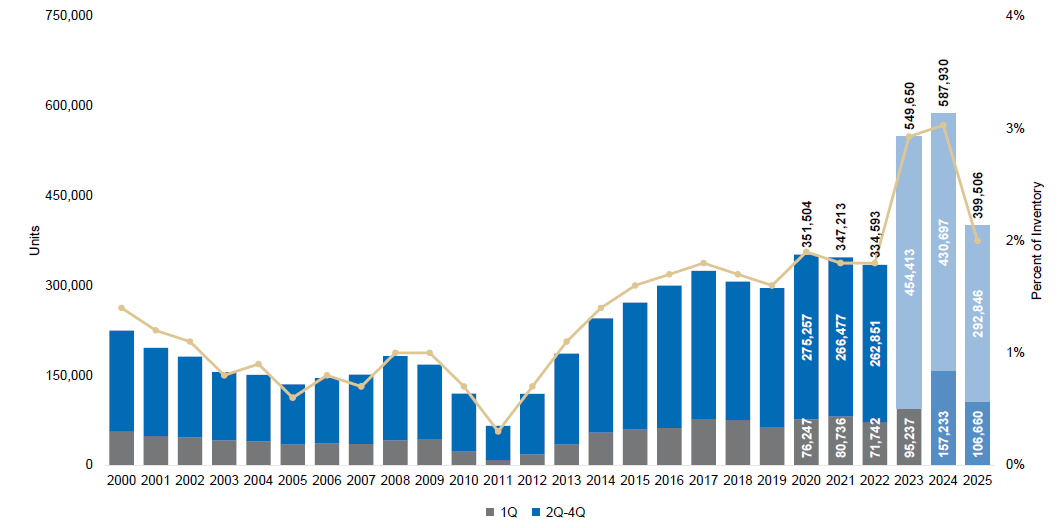

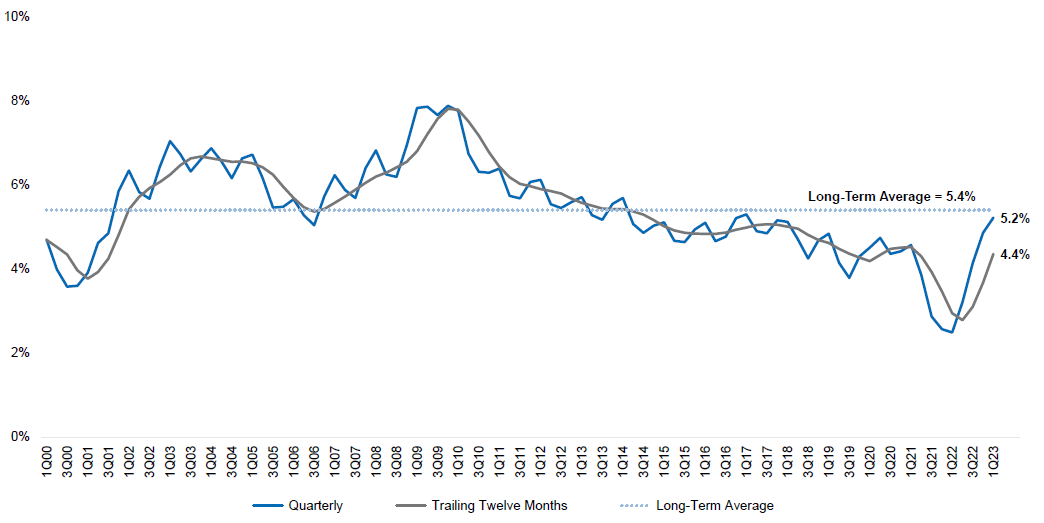

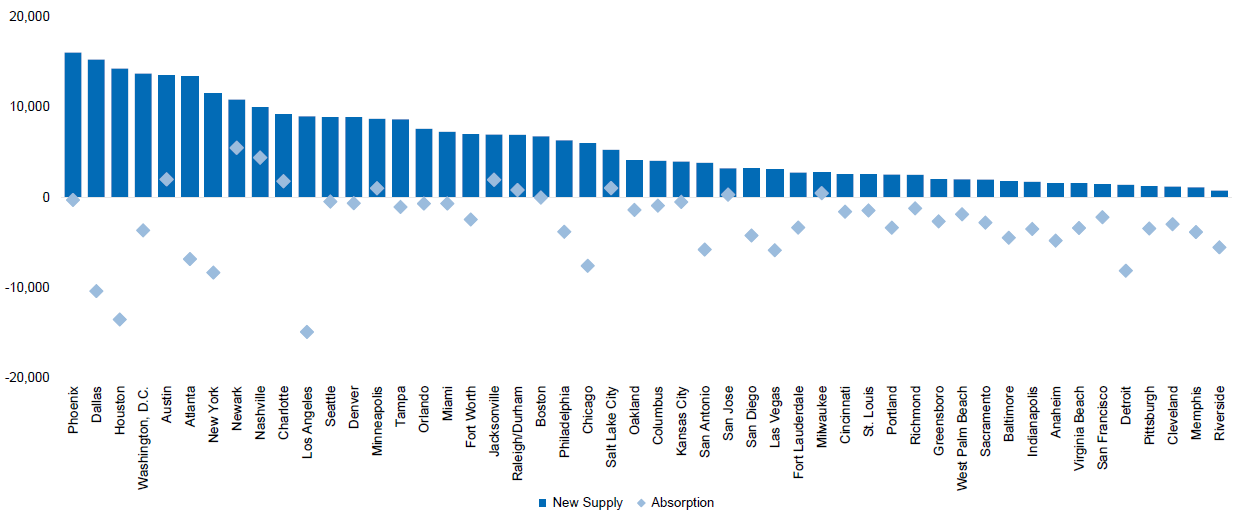

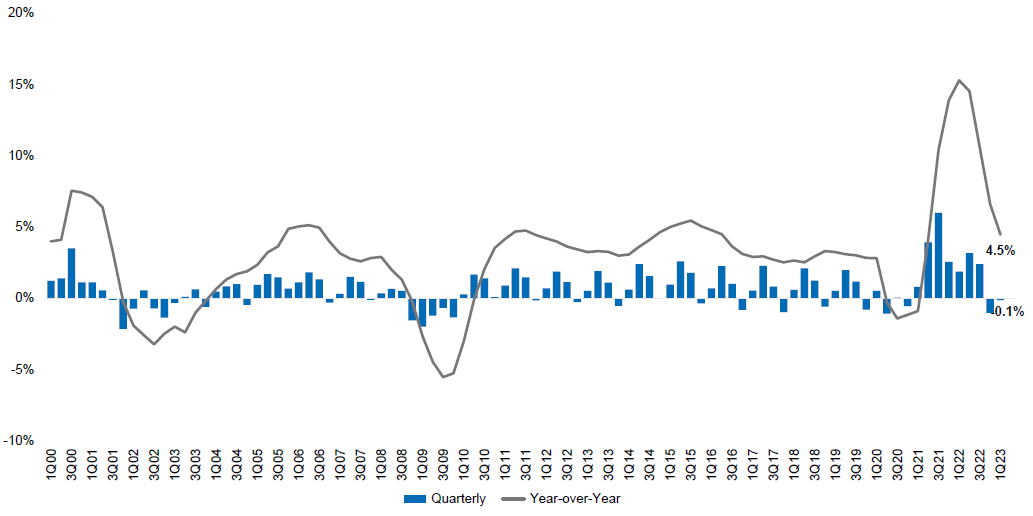

Multifamily fundamentals have been choppier than in the past few years but are still solid overall. As we continue to search for our next multifamily acquisition in a great location at a fair price, we are continuously taking stock of market trends, supply/demand metrics, rent growth (digestion), occupancy, and which markets have outperformed or underperformed. We read all of the major firms’ market research, including Newmark, Marcus & Millichab, CBRE, JLL, Walker & Dunlop, and Berkadia, among others. Here are a few current trends that are notable:

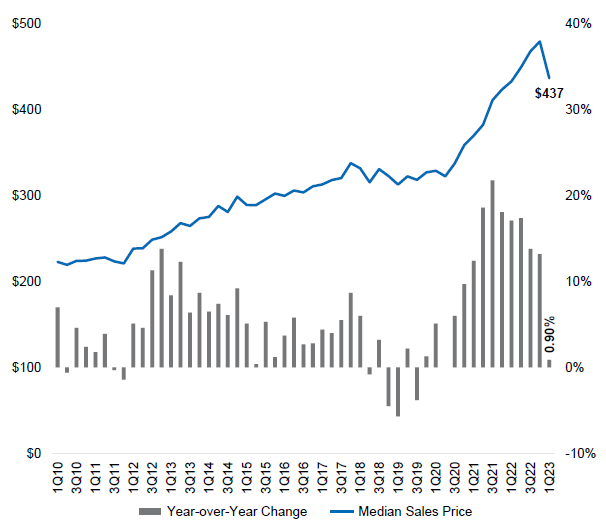

1) Home affordability is much worse now than just a few years ago, with the cost to own a median-priced home doubling versus 2019 pre-Covid levels. The cost of a median-priced home has increased from $315K pre-Covid to $437K today (down from a peak of almost $500K). When combined with the fact that 30-year loans are now priced at or above 7%, we see that a median-priced home total monthly cost burden is $2960 – $3460 per month, considerably more than many typical apartments which rent for $1200 – $2000 for even newer construction highly amenitized properties (median home ownership costs Principal + Interest $2360, property tax $200-$500, insurance $100-$300, maintenance $150, Water/Sewer/Trash $150). We note that pre-Covid home ownership costs were $1037 Principal + Interest = $1437 – $1837 monthly cost to own a median-priced home, with today’s burden about double the burden of 3-4 short years ago. In short, this means that many people cannot afford to buy or own a home and are thus renters by necessity.

Figure 1. Median Home Prices are Up Significantly But Off Peak Levels

Source: Newmark Research, Federal Reserve Bank of St Louis

Navigate the Choppy Waters of Real Estate with Confidence – Explore Multifamily Investments with Expert Advice

Are you intrigued by the resilience multifamily real estate investments exhibit, even in the face of turbulent market conditions? This area of investment serves as a beacon of stability, providing robust financial growth and a safeguard against economic upheaval – a unique combination in our current unpredictable financial climate.

We are thrilled to invite you to engage in a complimentary, no-obligation strategic consultation about multifamily real estate investing. This opportunity paves the way for you to participate in a stimulating exchange with our team of seasoned experts, who have not just weathered but flourished in the complex environment of the real estate industry.

Our discussion will be intensely personalized, focused on deciphering your unique financial aspirations and laying out a roadmap to achieve them via multifamily real estate investment. Our history of success underlines the potency of our battle-tested strategies, and we are eager to share this wisdom with the goal of lighting up your pathway toward meaningful wealth generation.

Don’t let the choppy waters hold you back. We heartily encourage you to reserve your free strategy session today. Let’s partner on your voyage to financial autonomy, leveraging the solid fundamentals of multifamily real estate.

In conclusion, we see that overall multifamily apartment trends like Occupancy and Rental Rate growth are still robust but are down from peak levels seen a couple of years ago. Substantially ramping new supply combined with lower overall demand due to economic malaise are making for a more challenging near-term environment. The high cost of owning a home is causing many people to remain renters, which is driving some stability to the overall multifamily apartment market. And, while near-term challenges exist, the multifamily apartment sector is a great place to invest for long-term cash flows, appreciation, tax advantages, and diversification away from stocks and bonds.

Leave A Comment