‘Tis the Season for the Pendulum to Swing

‘Tis the Season for Pendulum Swings in Politics and Rates. While ’tis the Season for shopping, non-stop office parties, presents, family get-togethers, egg nog, more family, and winter coats, this year also ’tis the Season for big and dramatic Pendulum Swings in both U.S. Politics and Interest Rates. After all, it was only seven short weeks ago that the entire world expected Hillary Clinton to assume

December 19, 2016, 10:00 am EST – Avid Realty Partners – By Craig Berger, CFA CPA

the mantle of leadership as future POTUS. And it was also only seven short weeks ago that we wrote about how silly it was that rates were still so low so close to the presidential election, no matter the outcome, with the #FedSittingOnItsHands. Well, now 10-year Treasury rates have increased by 80 bps to 2.60%, and rates reflect most to all of the upward moves we were expecting over the next year…but the move happened in just seven weeks!

Trump Rally is overdone at this point; caution may be the better part of valor in equities. Nobody knows how long this ‘Trump Rally’ in the markets will last. And it has been fun! But, a year-end rally is usually somewhat predictable as asset managers mark up their assets to increase annual performance, and this rally now feels like it’s getting overdone and reckless. Equity market risks seem somewhat elevated as asset prices are being bid up and with the many unknowns of this administration and the political changes likely coming (which we have discussed here). And while Bond prices have seen a somewhat sharp correction, we still feel like not all subprime and other risks are baked. Maybe it’s too early to feel this way, but when fundamentals, asset prices, and risk get out of alignment, it makes me think of painful down cycles of the past. Why put any money to work in this environment, some may ask? Well, at least in attractively priced MFU Apartment purchases, we can achieve strong cash flow yields through the economic ups and downs (with some variation, but still with end results that are strong). See below for more here.

Apartment Market is Still Frothy Despite Rate Move as Asset Yields Remain Attractive

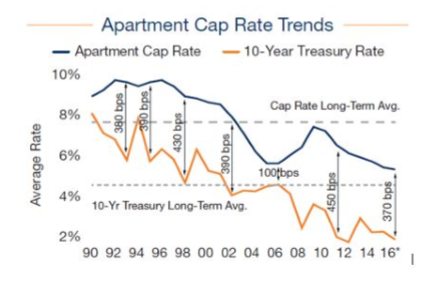

Apartment & Hotel Investors fret about the recent Interest Rate spike, but Apartment Operators are still snatching up properties. We have had more than a few investors reach out to us with concerns about potential impacts on MFU Apartment and Hotel investing due to the recent Interest Rate spike. The high-level, big-picture view is that we do expect property Capitalization Rates to rise slightly in 2017 as interest rates rise (by maybe 50-75 bps overall), putting some downward pressure on asset prices in aggregate. But, Apartment Operators still know that these assets are cash-flowing like crazy, with historically low levels of home ownership, rents that are many times too low, limited housing inventory, and in-place debt at attractive rates that often stretch out 10 years or more. So, these Operators are still buying (ourselves included). At our micro-level, we hope that higher interest rates mean we can more easily find profitable deals that meet our IRR thresholds before other institutions with a lower cost of capital or a 1031 exchange requirement snap up these properties with a 15-day close paying all cash…competing in this hyper-competitive environment can become tiresome!

Figure 1. MFU Cap Rates Should Expand by 80-100 bps on 10-Year Rate Rise

Source: Marcus and Millichap

Other asset classes could see more pressure from recent interest rate hikes. There are a variety of industries out there, many with publicly traded equity and debt securities, that are more highly levered to changes in interest rates than Apartment owners, in our view. Specifically, some energy, drilling, and mining firms are very highly levered with floating rate debt. Some industries, such as automakers, have benefited from large amounts of junk bond-driven customer purchases. We would expect to see increased financial pressure and choppiness as rates rise, and we think corporate America will be surprised with at least a few somewhat high-profile corporate bankruptcies among firms that are over-levered.

We Seek MFU Apartment Investors for 2017 and Beyond as We Build a War Chest

We seek Accredited Investors as we build an equity war chest for 2017 and beyond. If you are an Accredited Investor interested in reviewing some of our current deals, please contact us here. We plan on building our equity war chest for 2017 so we can be responsive to any good deals that may come our way. If more economic weakness hits than expected, we will be able to take advantage of even deeper price drops in this asset class. Unfortunately for us, because of the tremendous cash flows generated from this asset class, we know others in this market feel the same way we do. As such, MFU Apartment price drops may not be as steep as some would expect (or hope), but we still hope to find some better deals.

We are Risk-Protecting our Projects Through Cycles

We are Risk-Protecting our projects from softer prices and a possible economic slowdown. While the current economic environment is scary no matter how Trump performs, we are taking a variety of actions to risk protect ourselves while buying MFU Apartments at this point in the economic cycle:

- We are buying Class B/C value-add projects where we need to roll up our sleeves to upgrade interiors, exteriors, operations, and staff oversight;

- We are buying properties with strong in-place cash flows that we will improve further in our first couple of years;

- We are buying 1950s-1990s construction properties, where rents are one-half what they are in new construction apartments; If a recession comes, our properties are supply limited, and some portion of Renters will downsize into our properties from newer, more expensive properties.

- We are focused on buying in fast population growth zones in Central Texas, the Carolinas, the Southeast, and more;

- We over-capitalize our projects with plenty of cash so we can sleep better at night.

- We underwrite all our deals assuming that Cap-Rates increase by 150 bps or more (we model our exits around 8.5%-9.0% Cap-Rates), leaving us some downside protection;

- We are very careful about not overpaying for properties, and we utilize a number of techniques to achieve this.

We intend to cash flow through cycles, buy at reasonable prices, and create value along the way through active management and renovations. Our team is willing to do the hard work to optimize these properties from both a renovations and operations perspective.

Have a happy, healthy, and joyful Holiday Season and New Year ahead!!

Leave A Comment