“Only when the tide goes out do you discover who’s been swimming naked.”

Warren Buffett, One of the All-Time Great Investors

MFU Apartment Market Update: Beginning to See Some Price Compression

Focusing on Work and the things that matter. We are so tired of Politics and all the petty back and forth that has captured the country’s attention that we choose instead to focus on work while appreciating life’s other joys…family, hobbies, traveling, taking a walk in the sunshine, and making the most of our limited free time. Beginning to see MFU Apartment Asset Price Compression. On the work front, we have been focused on the MFU Apartment market and wish to provide an update. For the first time in years, we are beginning to see some price compression in MFU Apartment asset prices as interest rates have risen and as more supply of newly constructed assets come onto the market. While it has taken several months for interest rate rises to begin filtering through the still-frothy MFU Apartment market, it IS beginning to happen. Indeed, we saw rates rise most significantly after Trump’s unexpected Presidential victory, and one large Brokerage firm recently said that as many as 40% of deals in contract in mid-November were re-traded (primarily with lower prices) as both Sellers and Buyers gave some and absorbed impacts from rising interest rates. Indeed, we are close to buying a nice-sized MFU Apartment complex and think we will be acquiring this asset at a 12%-14% discounted price per door versus what similar assets traded for 12 months ago.

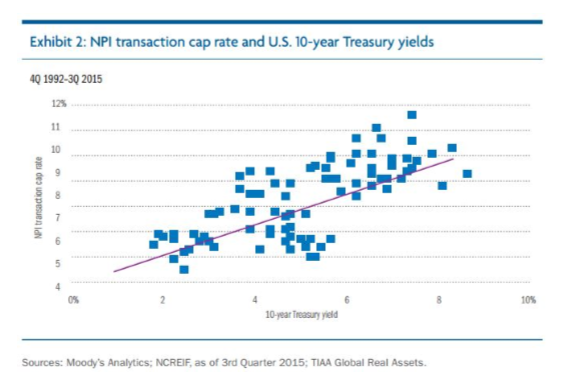

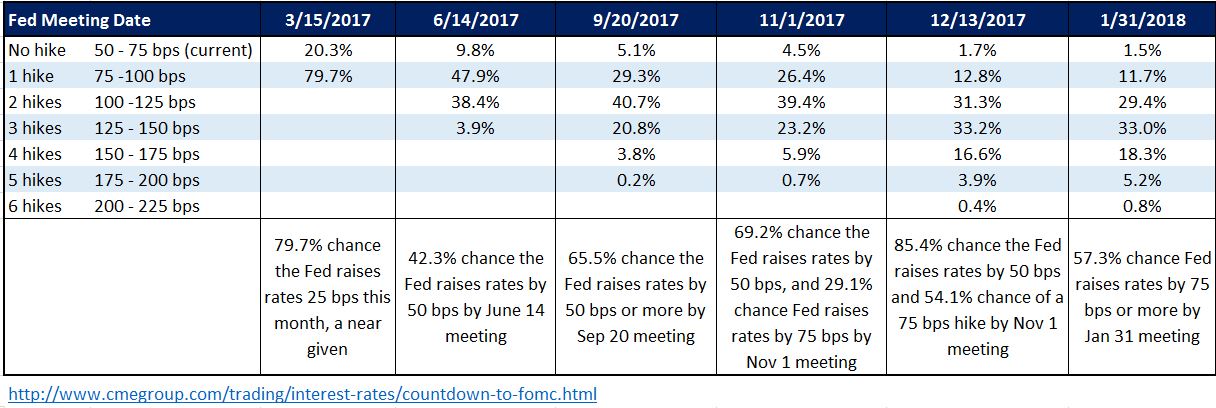

Interest Rate Analysis Suggests More Asset Price Compression Likely Coming. Below we take a closer look at Fed FundsInterest Rate expectations and what the futures market is currently embedding into expectations. In short, the market is now pricing in an 86.7% probability that the Fed will raise the Fed Fund rates by50-bps or more (two hikes) and a 57.3% probability that the Fed will hike interest rates by 75 bps or more (three hikes) by the January 31, 2018 meeting. If we do get two or even three rate hikes, we would expect MFU Apartment and other CRE asset prices to continue to trade at lower prices. Furthermore, we think that more CRE operators that own assets secured with floating rate debt will come under increasing pressure, likely leading to greater foreclosure rates. While we have not seen this type of activity in a while, yes, rising interest rates of 75-100 bps in total will likely cause some operators to go belly up and see their assets foreclosed upon! We want to be positioned to take advantage of any such market choppiness and acquire assets at even more attractive prices

The MFU Apartment Market is Still Too Frothy. We still see signs that the MFU Apartment market is too frothy. While higher rates and a shake-out may help cool some of these factors, most of these are still happening at present, leading us to believe that MFU Apartment market froth remains: A) Other institutional asset purchasers are willing to buy at 4-caps to 6-caps, and apparently have no problem over-paying; B) We are competing with firms that offer 15-day close periods with limited due diligence, limited on-site inspections, no contingencies of any sort, and with sizable earnest money deposits that go hard on day one; and C) Good MFU Apartment properties often attract 25-30bids from the market place. We know that great MFU Apartment assets can yield very strong cash flow, so we only expect a moderation of these forces at best and not a complete elimination of these factors, particularly given how much dry powder private equity firms are sitting on at this time.

A Closer Look at Interest Rate Expectations: 2-3 More Hikes in the Next Year

Figure 1. Fed Funds Futures Expectations Suggest 2-3 Rate Hikes in Next Year

Broader Economic Trends Still Healthy; Some Apartment Markets Healthier than Others

Economic Indicators are still Healthy at this point; Rising Interest Rates do pose a Growing Risk to Over-Levered Operators. Our Team at Avid Realty Partners continues to keep a close eye on Macro- and Micro-economic indicators to identify any real signs of potential slowing. For now, the domestic economy seems pretty healthy, with Job Growth still robust (although with slowing Growth Comps and the Workforce Participation Rate low), modestly rising wages, Business Spending still intact, and home prices up, leading U.S. consumers to feel the best they’ve felt in ten years. We have not seen substantial choppiness in Leading Economic Indicators, additional growth in Fed Balance Sheet assets, or meaningfully rising delinquencies in commercial realty debt (yet). That said, as noted above, rising interest rates do pose a somewhat substantial risk to the commercial realty market, given the substantial leverage being deployed by many firms.

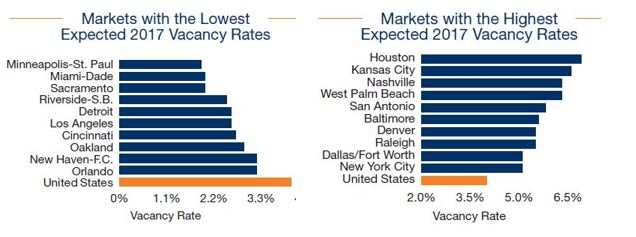

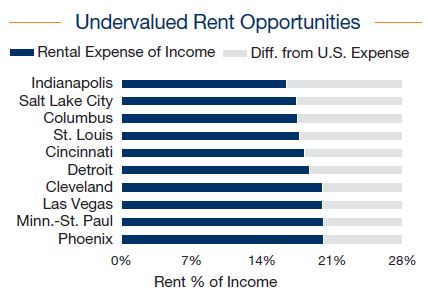

Attractive MFU Apartment dynamics exist in Atlanta, Cincinnati, Indianapolis, Las Vegas, LA, Orlando, Phoenix, St Louis, and others. In January, Marcus & Millichap published their 2017 U.S. Multifamily Investment Forecast, and we think it is worth reviewing again as we think Marcus & Millichap does a particularly good job with its research. Below are four tables that we find most useful (we did not do the hard work of creating this data, and we thank Marcus & Millichap for letting us refer to the data). From this and our own personal experience, we conclude: A) Class B/C properties remain supply constrained and will be much less impacted by the substantial new supply of highly-amenitized Class A products coming to market; B) Secondary and Tertiary markets offer the best opportunity to find cash-flow yield; C) Overall apartment demand remains strong as homeownership rates remain at all-time lows; and D) Demand from Millennials is robust as their earning power increases. Particular cities that have seen Absorption rates greater than new Apartment supply in three of the past four years or better, including 2017 forecasts, include Atlanta, Chicago, Cincinnati, Cleveland, Detroit, Indianapolis, Las Vegas, Los Angeles, Minneapolis-St Paul, New Haven, Orlando, Phoenix, Riverside-San Bernadino, Sacramento, Seattle, St Louis, and Tampa. While there are some surprising cities on this list (hello, Cleveland, and Detroit), many of these cities are our core focus markets for 2017. All Charts Sourced from Marcus & Millichap:

Figure 2. MFU Apartment Vacancy Rates: 2017 Forecast for Best & Worst Cities

Figure 3. MFU Apartments: 2017 Forecast for Most Undervalued Rental Rates

Hotels a Thinner Traded Asset Class with More Upbranding Opportunities vs. MFU Apartments

We Seek Investors for 2017 and Beyond as We Build a War Chest

Thank You for your time and attention, and have a great week ahead.

— Craig, Dave, Dallas, Erik, Mark, Paul, Rob, and the whole team at Avid Realty Partners

|

Leave A Comment