“It seems the harder I work, the more luck I have”

? Thomas Jefferson, a Great American Patriot

We Press Forward, Despite Politics and Rising Rates

An Update on the MFU Apartment Market Still Frothy as Heck

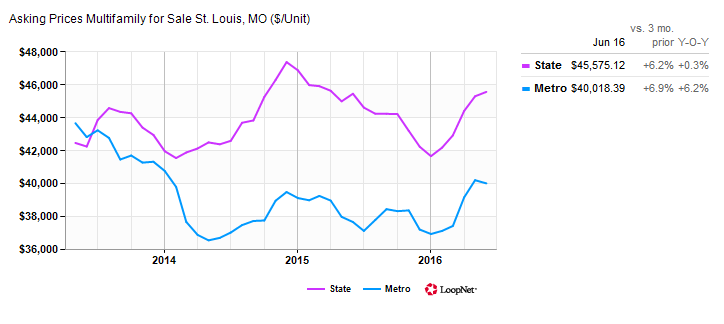

Hard to win deals in an overheated MFU Apartment environment. The MFU Apartment market remains frothy and overheated, in our view. In 2016, we underwrote 250-300 apartment deals and bid on roughly 45 of these properties. Despite this, we did not buy a single apartment building in 2016 because A) None of these deals met our IRR hurdle rate at a price the Seller was willing to accept; B) Other institutional asset purchasers are willing to buy at 4-caps to 6-caps and apparently have no problem over-paying; C) We are competing with firms that offer 15-day close periods with limited due diligence, limited on-site inspections, no contingencies of any sort, and with sizable earnest money deposits that go hard on day one; and D) Good MFU Apartment properties often attract 25-35 bids from the market place. While this has been a bit frustrating, we think patience is a virtue and that we will have more opportunities to buy better properties in 2H17 or 2018 as recent interest rate increases and additional Fed rate hikes work their way through the market. We are happy that we bought a great Hotel Asset in 2016, and we are happy with our 2015 MFU Apartment purchases. Key interest rates have risen by 63bps since Trump won the election, but Apartment cap rates have NOT risen in kind. We are somewhat amused (bemoaned) by the fact that 10-year Treasury Rates have risen by 63bps since Trump won the election and by 105bps since early July, but apartment cap rates have not risen in kind. For example, we recently took a second look at a property that was back on the market after failing to close in late November due to the quick upward move in interest rates. We asked the broker if the Seller was willing to take a lower price to account for this substantial upward move in interest rates, and his short answer was, “No because the economy and the property continue to improve” (which may or may not even be accurate). No offense to this broker, but what a crock! Without harping on this point, we think it is only a matter of time before cap rates do modestly rise, MFU Apartment prices decline on a per-door basis (slightly), and it is easier to work into attractive MFU Apartment deals as over-leveraged investors begin to feel some of this pain.

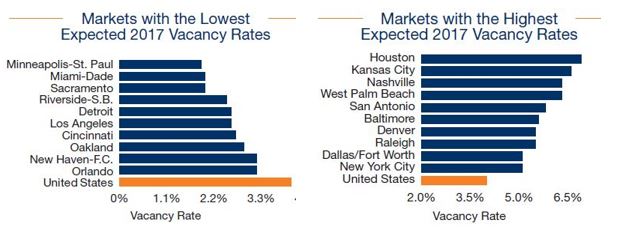

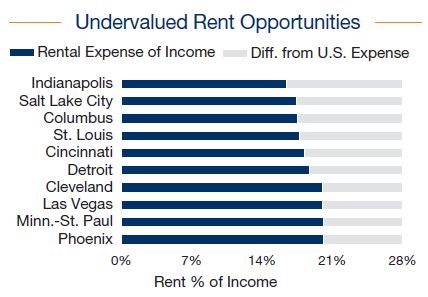

Attractive MFU Apartment dynamics exist in Atlanta, Cincinnati, Indianapolis, Las Vegas, LA, Orlando, Phoenix, St Louis, and others. Marcus & Millichap recently published their 2017 U.S. Multifamily Investment Forecast, and this document is extremely detailed and helpful for identifying attractive apartment markets. While we read a lot of broker research on this market, Marcus & Millichap does a particularly good job with its research. Included below are five tables that we find most useful. Just to reiterate, we did not do the hard work of creating this data, and we thank Marcus & Millichap for letting us refer to a few of their many tremendous graphs and insights. Some of our conclusions remain consistent with our prior views: A) Class B/C properties remain supply constrained and will be much less impacted by the substantial new supply of highly-amenitized Class A products coming to market in many cities; B) Secondary and Tertiary markets offer the best opportunity to find yield in this market; C) Overall apartment demand remains strong as homeownership rates remain at all-time lows; and D) Demand from Millennials remains robust as their earnings power increases, and they recover (somewhat) from the Great Recession. Particular cities that have seen Absorption rates greater than new Apartment supply in three of the past four years or better, including 2017 forecasts, include Atlanta, Chicago, Cincinnati, Cleveland, Detroit, Indianapolis, Las Vegas, Las Angeles, Minneapolis-St Paul, New Haven, Orlando, Phoenix, Riverside-San Bernadino, Sacramento, Seattle, St Louis, and Tampa. While there are some surprising cities on this list (hello, Cleveland, and Detroit), many of these cities are indeed our core focus markets for 2017. All Charts Sourced from Marcus & Millichap:

Figure 1. MFU Apartment Vacancy Rates: 2017 Forecast for Best & Worst Cities

Figure 2. MFU Apartments: 2017 Forecast for Most Undervalued Rental Rates

Figure 3. Employment Growth: 2017 Forecast for Best & Worst Cities

Hotel Opportunities are Currently Better than MFU Apartment Opportunities

Speaker Event in Manhattan on February 7 at 6:30 pm

We Seek Investors for 2017 and Beyond as We Build a War Chest

Thank You for your time and attention, and have a great week ahead.

— Craig, Dave, Dallas, Erik, Mark, Paul, Helen Rob, and the whole team at Avid Realty Partners

|

Leave A Comment