“Gratitude can transform common days into thanksgivings, turn routine jobs into joy, and change ordinary opportunities into blessings.”

? William Arthur Ward

Happy Thanksgiving to You and Your Family

We have so much to be Thankful for. As another year speeds towards a close, Thanksgiving presents a perfect opportunity to reflect on how much we have to be thankful for in this life. Unwinding and spending time with Family and Friends while partaking in Food and maybe a little Drink is the perfect way to appreciate the things that make life so special. After this volatile election cycle and the breakneck pace of today’s professional world, we could all use some downtime to refocus on what is really important. We at Avid Realty Partners are so thankful for our blessings, and we wish You and your Family the very best this holiday season and into 2017.

After this Volatile Presidential Election, Life Goes On (and we are Thankful for that Too)

Regardless of your position on this Election, life carries on. For those of you disappointed by the recent Presidential election results, the anxiety and uncertainty are unnerving, but life goes on. For those of you happy with the recent election results, you are excited by the prospects for change and believe that the People have spoken to Make America Great Again. Personally, I believe we should keep an open mind, good or bad, and assess the data as it becomes available, which only happens slowly over time.

Let’s speculate anyways. In the meanwhile, we can and will speculate as to what new policies will get enacted and the impact that they will have on the broader economy since this is the issue that matters most to the largest number of people. With both the House of Representatives and the Senate firmly in Republican control (slightly less firmly in the Senate but still likely a 52-48 scenario), legislation should get pushed through aggressively. So, following President-Elect Trump’s short policy preview video released yesterday, let’s take a look at some likely outcomes:

- Infrastructure spending will increase dramatically. We expect very substantial and much-needed investments in roads, bridges, rails, airports, and more. America needs it! This should have increasing impacts on employment, business growth, commodities consumption, and more. Let’s hope America has enough willing labor to work these jobs.

- Military spending will likely increase. Republicans and Trump will likely be tough on Terror and show Military Strength. Much of the sequester may be undone as Trump’s policies aim to inflate the economy towards a growth path. This should be a plus for military-exposed firms like Northrup, Boeing, etc.

- Taxes will be lowered and simplified. Trump’s tax plan calls for lowering and eliminating tax brackets, with the top Federal bracket falling from 39.6% to 33%. The Estate Tax may be eliminated and replaced with the capital gains tax and some higher limits instead. Some deductions and credits may go away.

- Obamacare will be repealed. Obamacare, which has dramatically raised the cost of many peoples’ medical insurance, will almost certainly be repealed. What’s harder to understand is what replaces it and how much of the recent rise in healthcare costs will also be rolled back. My guess is not very many of the higher costs will be rolled back, but let’s see.

- Renegotiation of foreign trade deals. Trump has said very clearly he will be renegotiating America’s foreign trade deals to be more fair to US workers. We will have to wait and see what concessions Trump can win from other countries, but leaders do seem to be somewhat fearful of Trump’s rhetoric, which can either lead to trade benefits for the US or backfire and lead to heightened trade wars.

- Looser energy policies and regulations are likely. This could lead to increased domestic supply and a possible second wave of energy-related Capital Expenditures. Perhaps coal can stage a modest (tiny) recovery.

- Repatriation of Foreign Cash may occur. US-domiciled corporations are sitting on a staggering $2.5 Trillion of offshore cash that cannot be repatriated today due to very high tax rates on this money. If Repatriation were allowed at a one-time 10% tax rate, as proposed, there could be big widespread economic impacts, including shoring up domestic banking institutions, promoting ongoing or one-time dividends to shareholders, and spurring additional investments in Realty, Equities, Private Equity, Tech Startups, or others.

Trump Still Cannot Overcome the Laws of Physics or Other Realities

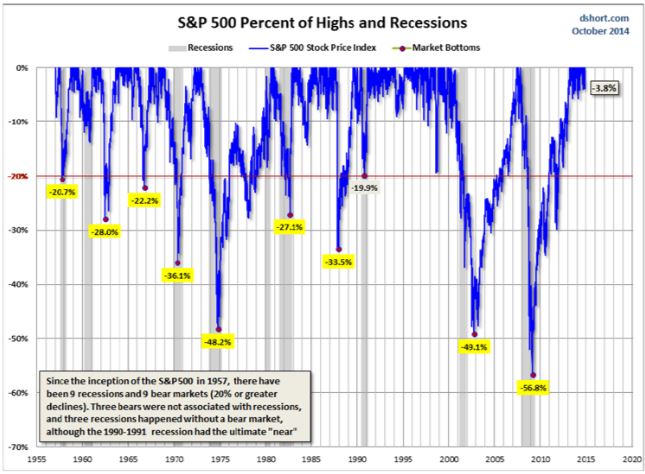

- The next Economic Downcycle seems due within the next four years. As noted, Recessions happen. Per Figure 1 below, there have been nine recessions since 1957; that’s one about every seven years or so. Can this economy keep going for four more years? It’s possible, but its not likely, in our view, and this is somewhat unfortunate timing for Trump or anyone elected President in 2016.

Figure 1. There Have Been Nine Recessions Since 1957, About Every Seven Years

- There is a mountain of Junk Debt and inflated economic activity as a result of Low-Interest Rates; Rising interest rates put this at risk of Rolling Over. We think Interest Rates have been too low for too long, with a variety of wicked consequences out there as a result. There is supposedly lots of Junk Debt that are mispriced relative to its level of true economic risk. There has been much growth in sales of capital equipment, rental cars, distribution warehouses, and so on due to very low-interest rates. How many cars did Ford sell because of fleet upgrades that are not sustainable and due to credit again being extended to those that do not warrant getting credit? What will Ford’s sales comparisons look like in 2017-2018 as a result of this unsustainable consumption? As interest rates rise, this all becomes a bigger risk, and we could see some company bankruptcies among firms with too much leverage that are not widely expected today.

- America’s Labor Force is mismatched to our country’s needs. America’s Labor Force and its available skills are somewhat poorly mismatched to Trump’s plans. We need a skilled and available Infrastructure Repair workforce, and America’s workers want to sit home and watch TV instead! It must be profitable for workers to work versus not work, and the US needs a vast Jobs Skills and Training program nationwide.

- Entitlement spending is still roughly 57% of total Federal Spending; Social Security and Medicare are on track not to make full payments. According to Politifact, 57% of total US Federal Government spending is on entitlements, primarily Social Security and Medicare. As America’s population of Boomers ages more, the system will be stressed even more. Social Security only has funding for full payouts for roughly another 20 years before payouts will decrease to 75% or so of promised payouts. This is a problem. Americans are addicted to Free Money in many cases, and this issue needs to be addressed by shoring up the entitlements system, paying out less benefits, or collecting more taxes here.

- Fed balance sheet assets have been Quintupled. Since 2008, the Federal Reserve’s balance sheet assets have grown from $900 Billion to current levels of $4.5 Trillion! This is a systemic and unknown risk, a ‘new paradigm’ that could roll back years of financial and economic progress for millions of people.

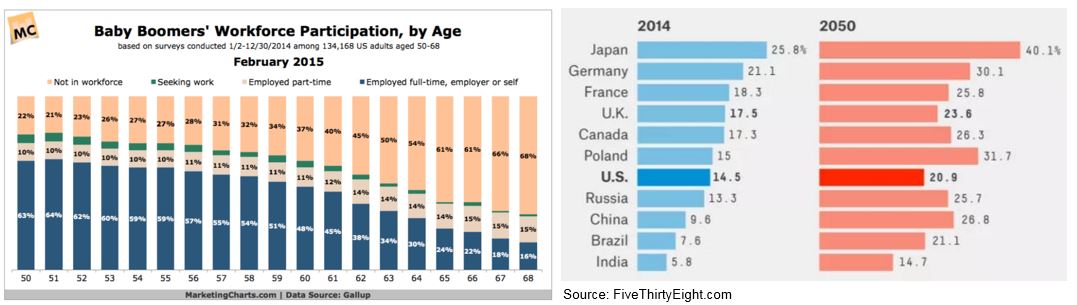

- A slowing economy is tied to aging population demographics and slowing birth rates. Much empirical evidence exists that any economy’s growth is closely tied to demographic trends and population birth rates as aging members of society participate less in the workforce. With the US seeing a much higher proportion of aging Baby Boomers and a decades-long decline in birth rates, it is likely that sluggish trends could continue versus the pace of growth seen in the 1950s-1970s. See Figure 2 for more detail here. Can Trump’s policies trump these over-arching principles? Only time will tell. Other countries with significant challenges here include Japan, Italy, Germany, and China, among others.

Figure 2. Baby Boomers’ Workforce Participation Rate (Left Graph) and Proportion of Countries’ Population over Age 65 (Right Graph)

We are Risk-Protecting our Projects Through Cycles

We are Risk-Protecting our projects from softer prices and a possible economic slowdown. While some of the above are scary no matter how Trump performs, we are taking a variety of actions to risk protect ourselves while buying at this point in the economic cycle:

- We are buying Class B/C value-add projects where we need to roll up our sleeves to upgrade interiors, exteriors, operations, and staff oversight;

- We are buying properties with strong in-place cash flows that we will improve further in our first couple of years;

- We are buying 1950s-1990s construction properties, where rents are one-half what they are in new construction apartments; If a recession comes, our properties are supply limited, and some portion of Renters will downsize into our properties from newer, more expensive properties.

- We are focused on buying in fast population growth zones in Central Texas, the Carolinas, the Southeast, and more;

- We underwrite all our deals assuming that Cap-Rates increase by 150 bps or more (we model our exits around 8.5%-9.0% Cap-Rates), leaving us some downside protection;

- We are very careful about not overpaying for properties, and we utilize a number of techniques to achieve this.

We intend to cash flow through cycles, buy at reasonable prices, and create value along the way through active management and renovations. Our team is willing to do the hard work to optimize these properties from both a renovations and operations perspective.

We Seek Accredited Investors and Attractive MFU Properties

We seek Accredited Investors and Off-Market MFU Apartment Properties. If you are an Accredited Investor interested in reviewing some of our current deals, just let us know. Also, we seek attractive off-market opportunities, particularly class B and C value-add MFU Apartments, the 100-250 range unit size in Dallas, Houston, San Antonio, Columbus, Jacksonville, Charlotte, Raleigh, Nashville, and others. If you have any such opportunities, please contact us.

Have a happy, healthy, and joyful Thanksgiving holiday ahead,

— Craig and Dave

|

Leave A Comment