September 2023 Inflation Status Check

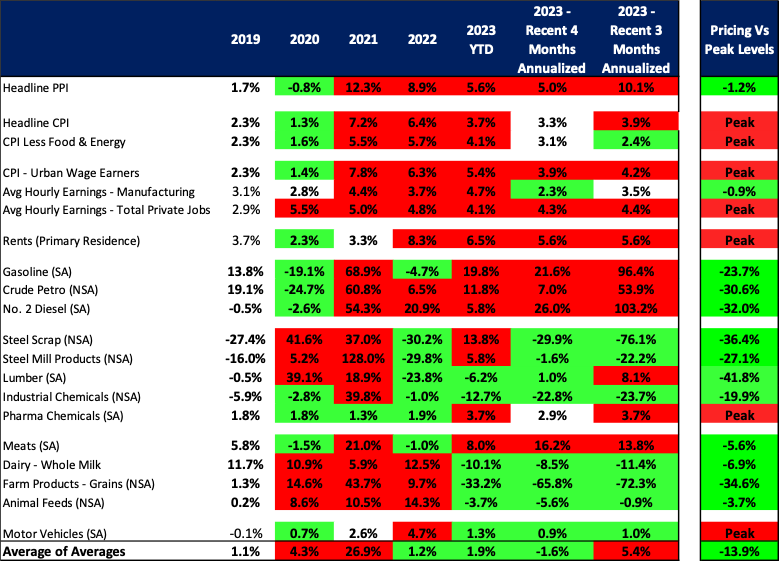

Recent setbacks in Energy, Rent, and overall Headline PPI have placed the Fed in a tight spot, making the likelihood of “higher for longer” more pronounced. We had hoped that inflation data would remain positive since our last update two months ago. However, we now witness indications suggesting that the battle against inflation might endure longer than anticipated. This is evident from the increasing pricing pressure in headline PPI, Oil, other energy sources, and Rent metrics—although the latter is somewhat beneficial for multifamily owners. We had always maintained that this battle against inflation would unfold in a “two steps forward, one step backward” manner. However, recent data hints at a potential additional Fed rate hike towards the end of this year, coupled with a marginally longer high-rate stance than we initially predicted.

Figure 1. Various Measures of Inflation: PPI, Energy, Wages Hampering the Fed’s Fight

Source: Avid Realty Partners

Oil’s Inflationary Threat

Oil poses the most significant risk to future inflation. President Biden’s choice to deplete the Strategic Petroleum Reserve for much of 2022—reducing it from approximately 650 million barrels of oil to around 350 million barrels—has backfired, with OPEC and Russia capitalizing on this situation. Elevated energy costs stand as a chief inflationary threat moving forward. In our view, the President’s myopic actions jeopardized the USA’s capacity to challenge our energy adversaries and to combat the inflationary trend. This strategic misstep is exacerbated by the administration’s decision to rescind numerous Alaskan oil drilling permits, thereby compromising US energy independence and raising the risk of gas prices reaching $5 per barrel in the upcoming quarters.

Job Market Resilience & Wages

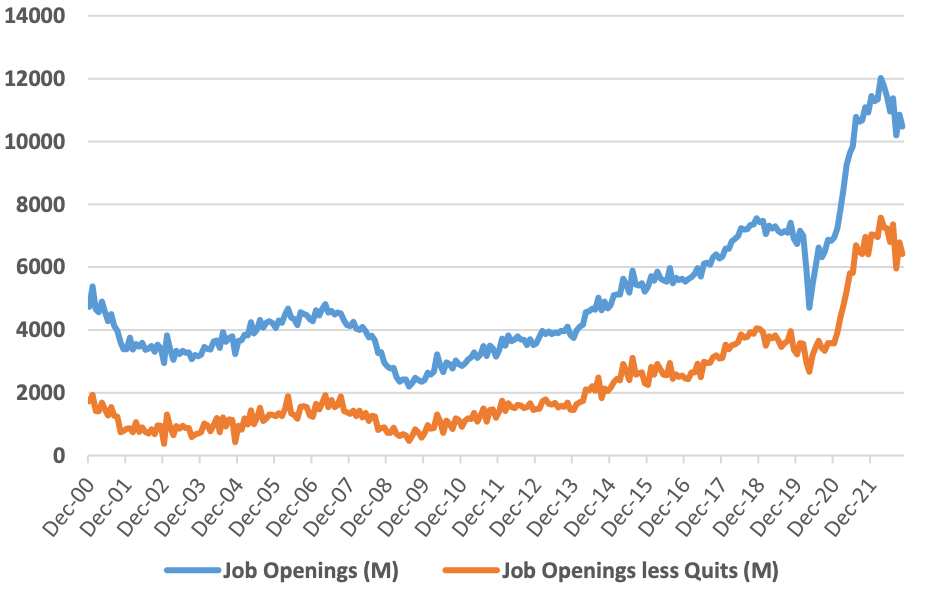

Although the job market and wages have slightly cooled, their overall resilience doesn’t aid in combating inflation. Readings on Labor and Wages have decelerated over the recent months—a positive development. However, they remain hotter than the desired levels due to the deferred impact of yearly raises and a persistently tight labor market. The job market has seen a dip since its apex in early 2022, which is beneficial for cooling the economy and counteracting inflation. Yet, the job market’s relative strength continues 18 months into the Fed’s cooling endeavors. This enduring strength possibly supports a ‘soft landing’ scenario, also bolstering the ‘higher for longer’ interest rate impacts currently evident in data.

Figure 2. Labor Market Strength Supports Soft Landing and Higher for Longer Scenarios

Source: Avid Realty Partners

Reaching the Fed’s Inflation Target

Attaining the Fed’s inflation target of 2% may be a distant dream for the near future. A possible alteration in their communication might be on the horizon. While we are optimistic about eventually reigning in inflation, the economy might not soon achieve the Fed’s 2% inflation target. Instead, it might hover between 2.5% and 3.5% for a while, which could lead the Fed to amend its communication strategy in the forthcoming quarters. We perceive certain data points (Oil, Rent, Wages, PPI) as temporary hiccups in the anti-inflation battle. A sustained decrease in the M2 money supply, Fed balance sheet assets, and overall government spending is imperative to prevail in this contest. As real estate investors navigating a credit contraction phase, we are prepared for a prolonged battle, if required.

Revisiting the Root Causes of Inflation

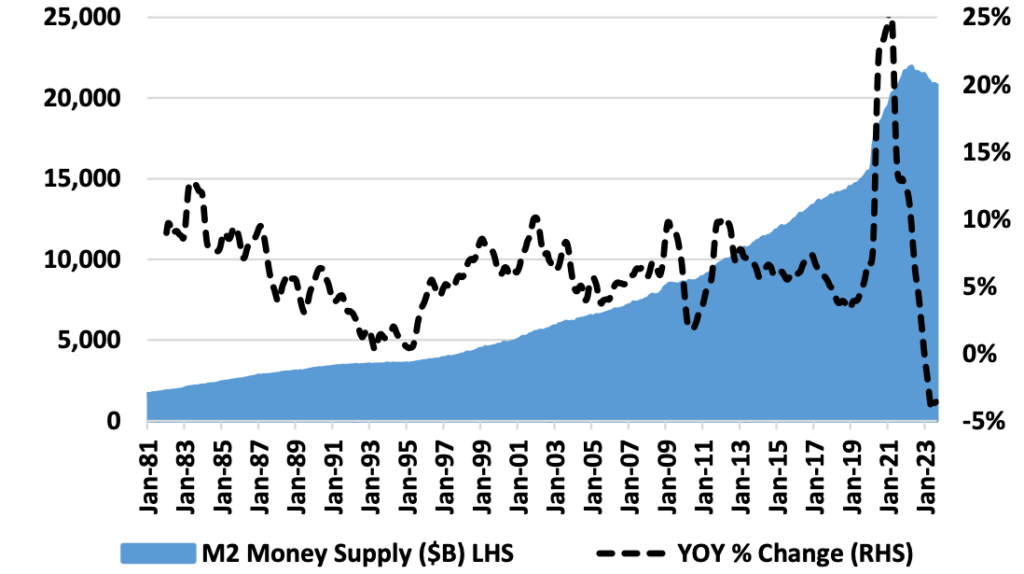

Exorbitant Quantitative Easing and excessive Government Stimulus money are culprits. We estimate that 70%-80% of the inflationary root cause can be attributed to the Federal Reserve’s unchecked experiment labeled Quantitative Easing (QE). As illustrated, the Fed recklessly augmented the US’s M2 Money Supply by 43% from the onset of COVID-19 in February 2020 through early 2022. This 43% surge in the US M2 Money Supply in a span of 23 months unsurprisingly correlates with a 43% inflation rate over recent years. Other inflationary factors encompass repeated Federal and State Government stimulus initiatives, many of which were redundant and catered to the affluent segment that didn’t require such financial aid. This can be interpreted as a form of political appeasement. We believe supply chain snags contributed to less than 10% of the inflationary cause, while the Russia/Ukraine conflict accounted for under 2%.

Impact of the M2 Money Supply on Inflation

The M2 Money Supply and the Federal Reserve’s Balance Sheet significantly influence inflation. Did you know that the Federal Reserve amplified the M2 Money Supply at a rash annual rate of 7.75% for 15 consecutive years spanning from July 2007 to July 2022? Such fiscal recklessness by the Fed governors is alarming. The ensuing graph underscores the following:

Important Statistics:

- The M2 Money Supply’s unchecked growth has now plummeted below historically typical YoY growth rates due to Quantitative Tightening as the Fed seeks to rectify its past oversights.

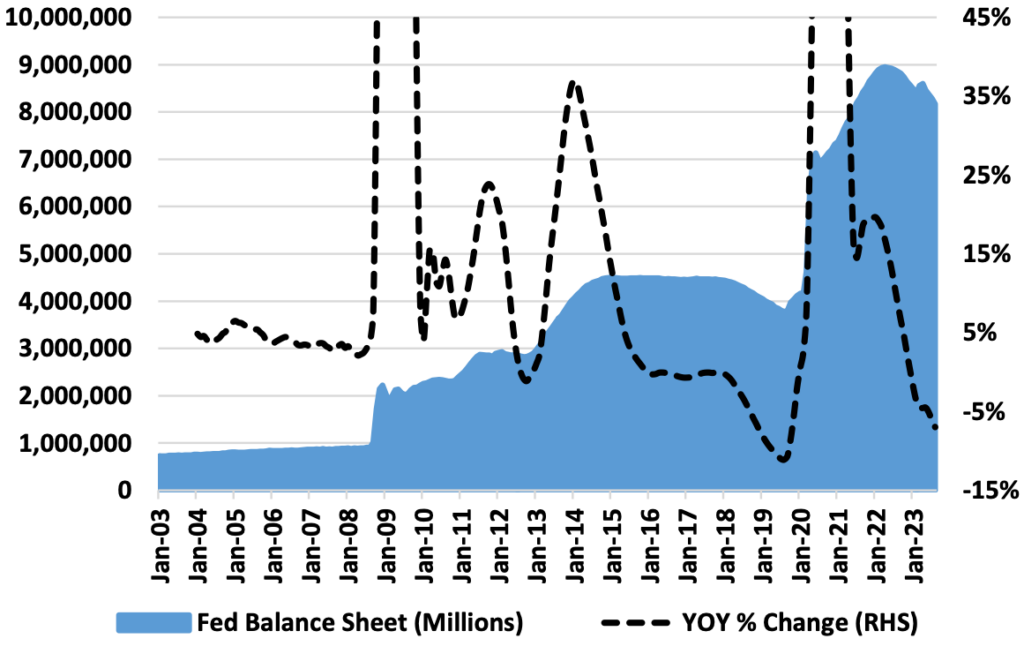

- The Fed must not just stabilize but aggressively contract its balance sheet and the M2 Money Supply if it genuinely aims to attain inflation rates under the 2% target.

- The last instance of M2 Money Supply growth exceeding 10% occurred in the 1970s, which precipitated its own set of inflationary challenges during the late 1970s and early 1980s.

It’s worth noting that the Fed has curtailed the M2 Money Supply by an impressive 5.2% since its peak in April 2022, and has also reduced its total Balance Sheet by 8.7% since then. This equates to a $785 Billion drop in Fed Assets from their zenith; a sum trivialized when considering the amounts allocated by Congress and the President to undocumented immigrants, student loan borrowers, or the Ukraine war effort. The Fed and Congress must take decisive action to address these financial missteps.

Figure 3. Growth in the M2 Money Supply is the Root Cause of Inflation—QE The Fed’s Frankenstein Baby

Source: Avid Realty Partners and fred.stlouisfed.org

Figure 4. The Fed’s Balance Sheet Grew Recklessly Fast, and Has Fallen Just 6.5% From Peak Levels of April 2022

Source: Avid Realty Partners and fred.stlouisfed.org

Taking Control in a Time of Inflation

The current trajectory of inflation underscores the importance of insightful financial decisions, especially within the real estate sector. The multifamily real estate market, in particular, offers a tangible hedge against inflation and a way to ensure the security and growth of your investments. If you’re an investor looking to navigate the shifting economic landscape, partnering with experts with both knowledge and foresight is vital. At Avid Realty Partners, we’ve weathered economic storms and know how to pivot strategies to ensure optimal results. Are you ready to make informed investment choices in these uncertain times? Book a free strategy call with us today to discuss how we can enhance your real estate portfolio’s resilience and profitability. Your financial future deserves the expertise of seasoned professionals. Secure your assets. Secure your future. Secure your peace of mind.

Conclusion

While inflation is being gradually curtailed, a significant amount of work remains. Inflation is being progressively subdued, but achieving the Fed’s 2% target might be a distant goal due to the persistent upward price pressures in Oil, Wages, and Rent and the residual impacts of aggressive government intervention in the financial markets. Considering the Fed’s Balance Sheet’s average growth of 7.75% for 15 consecutive years (from July 2007 through July 2022), it might be a while before the economy revisits the 2% inflation benchmark. The federal government needs to curtail its indiscriminate spending and handouts, while the Fed must shrink the M2 money supply and its balance sheet. Though a ‘soft landing’ still seems probable for now, adopting a prolonged higher-rate approach might be essential to offset the colossal fiscal freebies dispensed during the COVID pandemic. As real estate operators, we remain vigilant, readying ourselves for a prolonged journey, and we continue to scout for lucrative opportunities in the multifamily sector to ensure robust returns for our investors.

Leave A Comment