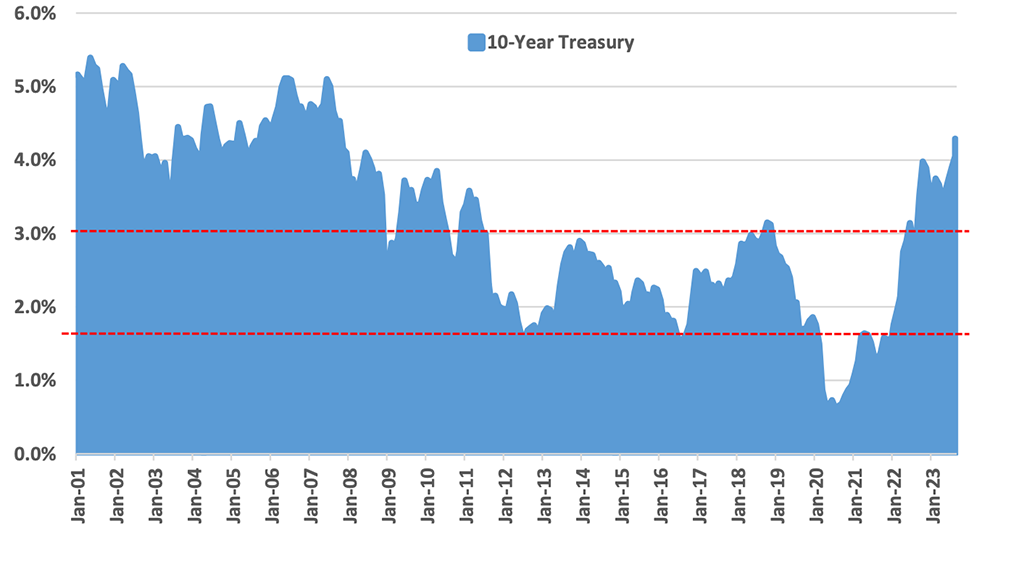

On Monday, August 21, 2023, the 10-year US Treasury rate reached a new 15-year high, a level not seen since October 2007. As discussed last week, rates remain at historically low-to-reasonable levels but appear to be above the ‘normal’ expected range of 1.8% – 3.1% that we anticipate the 10-year Treasury rates will revert to in the coming years.

Figure 1. US 10-Year Treasury Rates Hit New 15-Year High, But Still At Historically Reasonable Levels

Source: Avid Realty Partners, fred.stlouisfed.org

The bond markets are conveying a message, and our elected political leaders ought to listen.

Clearly, the bond markets are communicating a sentiment. For the sake of our nation and our children’s futures, I hope US politicians in Washington, DC, pay attention. What is the bond market suggesting? It’s challenging to pinpoint, but the message seems to be: “The United States’ financial foundation is in disarray, characterized by rising risk premiums and dwindling confidence in the future viability of our nation and its currency.”

Here are probable reasons for this message:

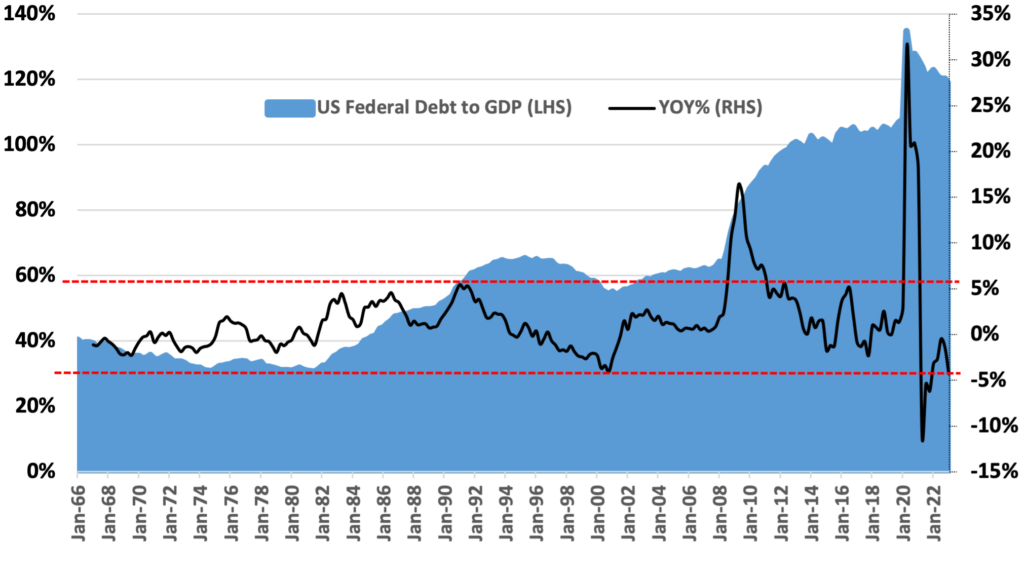

First, the US Federal Debt-to-GDP Ratios are alarmingly high and show signs of increasing further.

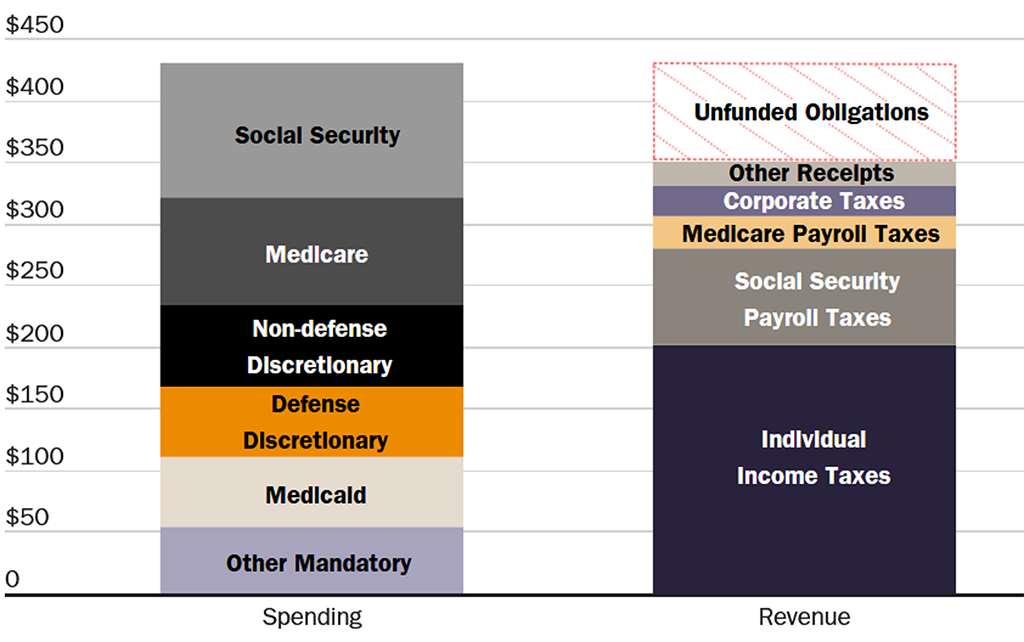

The US Federal Debt is astronomical. On a Debt-to-GDP basis, it has reached historically precarious levels. At present, the US carries approximately $31.5 trillion in Federal Debt, equating to about $93,000 per person. This is 120% of the annual Gross Domestic Product (GDP), a decrease from the peak levels observed during COVID-19 but a leap from the 30% of GDP only four decades ago in the early 1980s. These numbers alone are daunting, yet the US has an additional $80 trillion in unfunded Social Security and Medicare obligations over the next 75 years in present-value dollars! The Financial Report of the US Government predicts that the total US Federal Debt-to-GDP ratios will ascend to 200% by 2046 and an astonishing 566% by 2097. The same report postulates that by 2050 (a mere 27 years from now), the debt service of the US Federal Government will consume 10% of the annual GDP — a staggering proposition. No government in history has recuperated from such immense debt. When will our elected ‘leaders’ acknowledge and act decisively, curtailing expenditure, optimizing federal programs, ending ceaseless free-money distributions, balancing our Federal budget, and financing Social Security and Medicare commitments?

Figure 2. US Federal Debt-to-GDP Ratios are Dangerously High

Source: Avid Realty Partners, fred.stlouisfed.org

Figure 3. Unfunded US Government Obligations Will Total $80 Trillion Over 75 Years

Note: The graph displays total projected non-interest spending and revenue in 2022 present value terms.

Source: Cato.org and Dept of Treasury, “The 2022 Financial Report of the U.S. Government,” 03-24-23

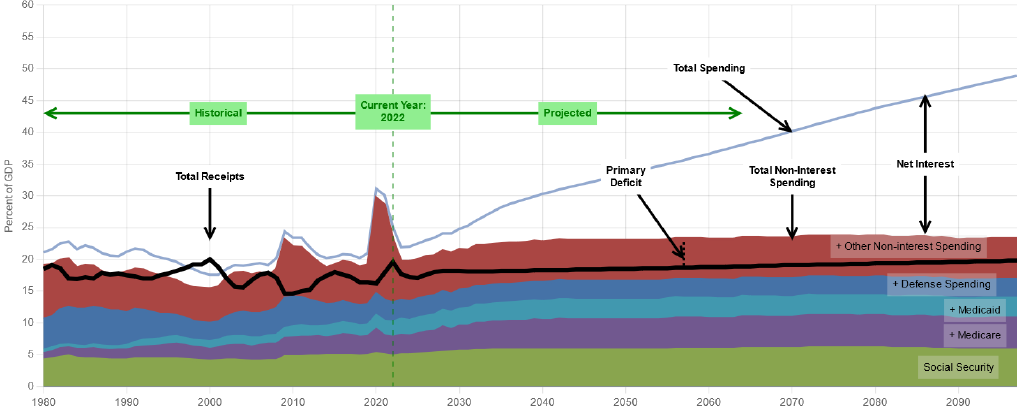

Figure 4. Federal Government Hasn’t Run a Surplus Since 2001; Debt Service Forecast at 10% of GDP in 2050

Source: Dept of Treasury, “The 2022 Financial Report of the U.S. Government,” 03-24-23

A financial crisis might be the only wake-up call, and by that time, it may be irreversibly late.

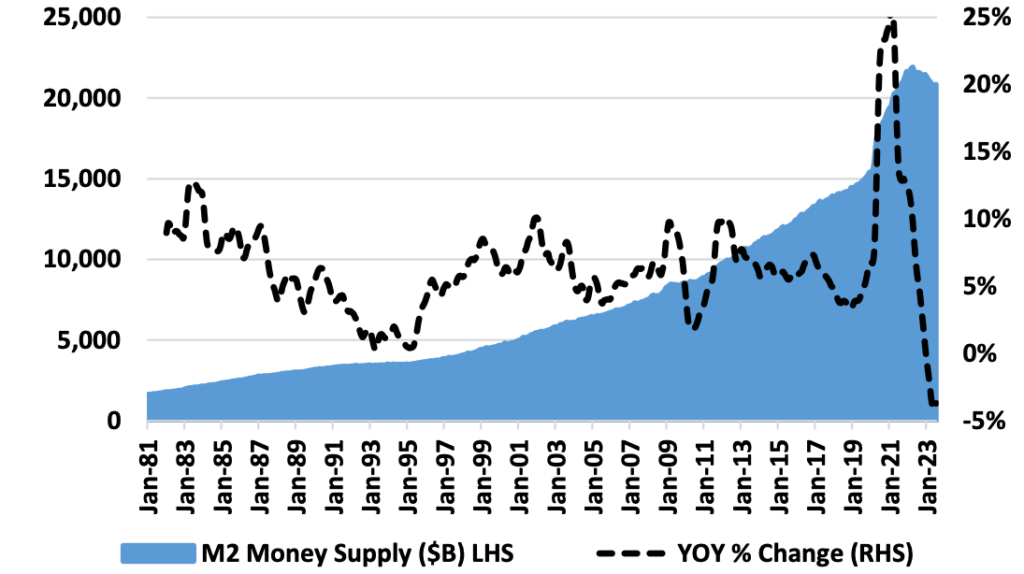

Second, the expansion in Money Supply has incited inflation, diminished the US Dollar’s value, and jeopardized its status as the World’s Reserve Currency.

The US enjoys the perks of having its currency, the US Dollar, recognized as the global reserve currency. This status grants the privilege of international trade in dollars, a reduced capital cost by efficiently selling US Treasuries (thereby funding our perpetual government expenditure deficits), cheaper imports, and slightly pricier exports. Furthermore, commodities, including oil, are traded in US Dollar denominations on global markets, simplifying operations for US businesses. The US Dollar’s standing as a reserve currency hinges on the robustness, reliability, and trustworthiness of the US financial system. However, escalating Federal Debt, political volatility, and the recurring turmoil surrounding Debt Ceiling negotiations challenge this system’s credibility. Such issues considerably amplify uncertainties regarding the US financial system’s reliability, potentially endangering the US Dollar’s global reserve currency position. As evidenced, the Federal Reserve’s surge in the MS money supply during and beyond the COVID-19 pandemic caused a spike in inflation, devaluing the US Dollar. The Fed’s QE intervention stabilized the economy during the crisis’s zenith, but it spurred inflation and was arguably imprudent. Both the Fed and our elected representatives’ decisions threaten the US Dollar’s reserve currency status, possibly intensifying the impending financial crisis for ordinary Americans.

Figure 5. The Federal Reserve’s Growth in M2 Money Supply was Reckless

Source: Avid Realty Partners, fred.stlouisfed.org

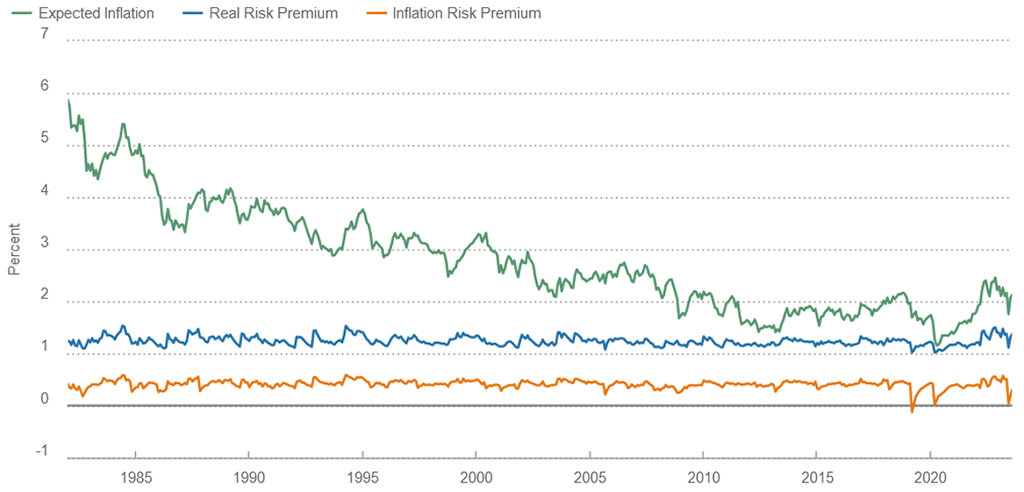

Third, due to these problems, the US Risk Premium has risen, reflected in the pricing of US Treasuries.

The aforementioned challenges, combined with the apparent lack of genuine leadership from the Federal Reserve and our elected representatives, mean that the Treasury markets have to promise higher returns to entice investors to US Treasuries. In essence, the US Risk Premium is on the rise. Although it has rebounded significantly from COVID-19 pandemic lows, it could escalate even further.

Figure 6. US Bond Risk Premiums are Up Off the Lows, But Could Still Go Higher

Source: ClevelandFed.org

What implications does this have for the Multifamily Apartment investment market?

There’s a lot of data to unpack! We still believe that the multifamily apartment sector is ‘essential,’ given that people will always need shelter. Even if the US Federal Government collapses someday, individuals will still require homes and apartments. A few additional insights:

1) Considering its rapidly growing debt and interest payment obligations, the US Government cannot persist in offering 4.5% interest rates on US Treasuries without straining finances and causing debt service payments to soar. We, therefore, foresee a decline in Treasury rates.

2) With reduced yields and increasing domestic political and financial instability, fewer nations might be inclined to purchase US Treasury debt. This could compel the government to recalibrate its spending or reduce Social Security and Medicare benefits.

3) If the Federal Reserve or political leaders attempt to ‘inflate our way out’ of the growing fiscal calamity, those owning hard assets like apartment properties will see their asset values increase in tandem with inflation.

4) We can’t influence these macro factors, so we remain committed to acquiring top-tier multifamily assets at fair prices or lesser-quality assets at a bargain, with a strong focus on both property-level and corporate-level execution. After all, everyone requires a place to live, and we aim to be an integral component of the housing ecosystem for many more decades.

Taking Control Amidst Uncertainty: Your Next Investment Move

The dynamics of the US economy, the bond market’s reactions, and the multifamily sector intricacies have been laid out. It’s evident that as we navigate these uncertain waters, intelligent and strategic decisions will be paramount to safeguarding and growing our investments. Recognizing the shifts, anticipating the changes, and acting proactively will be the difference between mere survival and thriving success.

For real estate investors, multifamily properties remain a promising avenue, regardless of the macroeconomic winds. At Avid Realty Partners, we’ve weathered many storms, harnessing our vast experience and insights to ensure optimal returns for our investors. If these challenging times have raised questions about your investment strategy or if you’re considering a pivot towards multifamily assets, now is the moment to act.

Act now and leverage our expertise. Schedule a free strategy call with us, and together, let’s chart the path to resilient and prosperous real estate investments in these volatile times.

Remember, in an unpredictable economy, having a trusted partner can make all the difference. Don’t leave your investments to chance. Secure your future with us today.

Leave A Comment