“Elections belong to the people. It’s their decision. If they decide to turn their back on the fire and burn their behinds, then they will have to sit on their blisters.” -Abraham Lincoln

This Presidential Cycle is a Real Doozy

This cycle is a doozy. Watching Donald Trump and Hillary Clinton lob zingers at each other Monday night during the first presidential election debate, I couldn’t help but wonder which candidate Honest Abraham Lincoln would be supporting this cycle. Indeed, there are no easy answers this time around, with the world facing an increasing array of political and financial challenges, violent extremist hot spots, and growing political unrest due to income inequality and a litany of other social justice issues.

It’s still bad out there, but it is getting better! While thinking about the state of the World today can be a bit of a #Downer, it’s important to remember that, globally, more people’s basic needs (food, water, housing) are being met than ever before, more people are getting an education than ever before, and the shining light of cell phone video cameras are upping the standards of what is considered ‘acceptable behavior’ in different countries and societies that may not have been so exposed in the past (with Social Media playing an ever-expanding role here). While some progress has been made in elevating people’s personal and living standards around the globe; clearly, much more work remains to be done in the years ahead.

People still have to live somewhere. It is also important to remember that no matter what happens in the World, people will always need a place to call home. Whether Home is a rental, owned, or even temporary quarters while away on business or leisure, providing an outstanding Customer Experience matters and will continue to matter for decades to come. Fulfilling this need has been our primary focus in recent years, and it has been personally fulfilling to us on many levels.

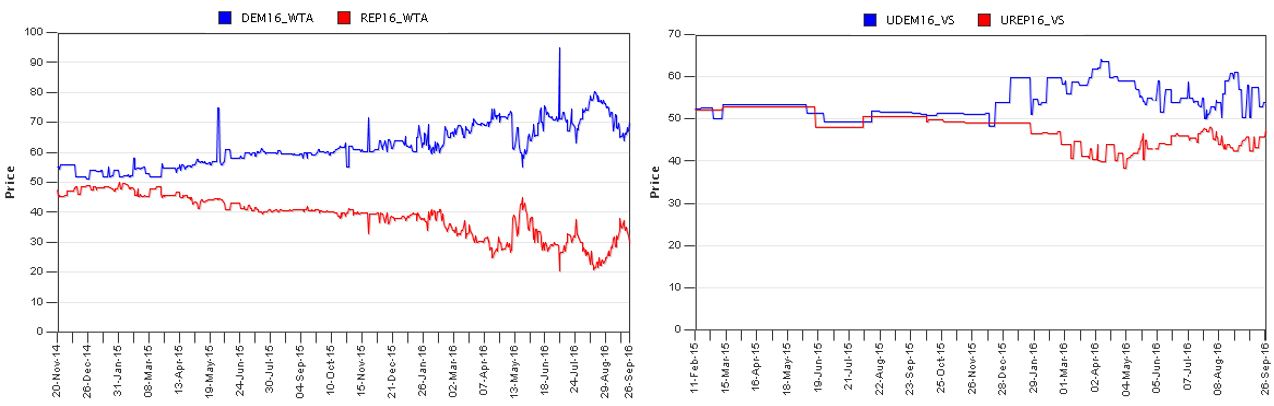

IEM Markets still have Hillary in the Lead, with a roughly 68% chance she will win the election. The IEM is a political ‘Futures’ market where people can place small bets of $5-$500 on various candidates and outcomes. Since its inception in 1988, this market has had a decent track record of predicting the likely outcome of a presidential election at any point in time. The IEM tool still shows Hillary in the lead, with a 68% probability that she will be elected our next Commander-in-Chief (left graph), but clearly, the race has tightened meaningfully since late August. The IEM also shows a roughly 52% to 48% popular vote count advantage for Clinton at the moment (right graph). While nobody yet knows the outcome of this cycle, it is important to remember that the Winner will likely not be determined by which candidate receives the most votes but rather will be determined by those who count the votes (see Florida 2000 for more here).

Probability of Winning Election Expected Share of Popular Vote

We are Actively Buying MFU Apartments; Cash Flow Opportunities are Still Strong

Apartment Prices are up, but so are Rents; Cash flowing properties are still available. As mentioned, we are actively buying MFU Apartment properties and are looking at various attractive markets around the country. While it is certainly true that MFU Apartment prices have gone up solidly on a per-door basis, it is also true that Rents are increasing at a similar clip. We have had recent success finding attractive, high cash-flowing B- and C-class apartments in secondary and tertiary cities like St Louis, Columbus, Cincinnati, Greensboro, Jacksonville, Atlanta, Fort Worth, and more. We are interested in owning some of these assets, and indeed we have bid on three MFU properties in the past week alone. We are finding opportunities to bring amenities to these communities, to renovate unit interiors and property exteriors while driving increasing returns for Investors. In some instances, Landlords just have not been aggressive about keeping pace with market rental rate increases. In other cases, the Landlords do not want to spend the time, effort, and money it takes to update a property fully. Our team at Avid Realty Partners is willing to do the hard work to optimize these properties from both an improvement and operations perspective.

Market in Focus: St Louis, MO

We are buying more property in St Louis, MO. We like this St. Louis, a Show-Me town. In addition to being Craig’s original hometown and where his family resides, the cash flow yields here are very attractive. We already own a 95-unit apartment building here that produced greater than 10% cash-on-cash returns in year one, and we have recently put in a bid on a 203-unit property that should deliver even stronger returns and with more scale than our first property here. The property we are bidding on will be priced at roughly $25K per door or better, with $500 monthly rent, and we cannot find this level of value elsewhere. Let’s look at a couple of interesting trends happening in St. Louis, MO:

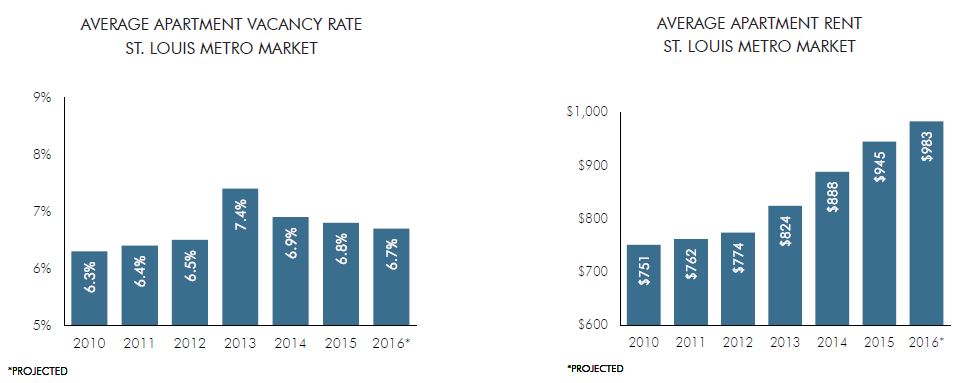

Rental Rates are growing, and Vacancy Rates are falling. Here we see that St Louis has experienced robust Rental Rate growth in the past five years and that apartment Vacancy Rates are at reasonable levels and falling. This is encouraging relative to the somewhat modest growth in MFU per-door pricing we have seen in the market. This data is sourced from Berkadia.

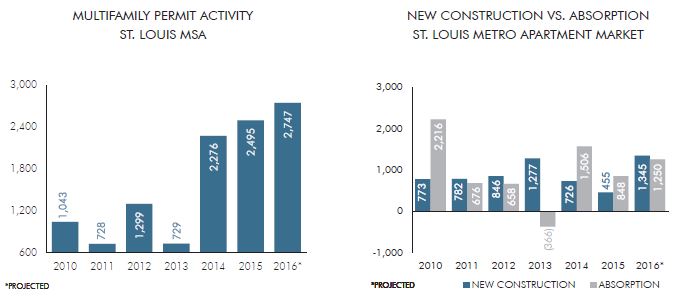

Supply growth is low, and full absorption is being achieved. Here we see that St. Louis is experiencing only modest MFU Apartment Supply growth and has seen nearly full Absorption levels in the past three years. This suggests that supply/demand should stay relatively balanced in the coming years, all else being equal. This is a plus for the St. Louis market as compared to other markets where significant supply is coming on. This data is sourced from Berkadia.

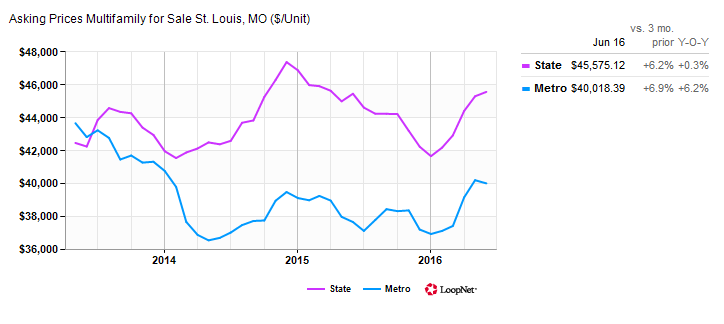

MFU Apartment Sale Prices (per door) have only increased modestly. Here we see that St Louis MFU Apartment sales prices, on a per-door basis, have only increased modestly in recent years. While this data may not be too strong, we would guess that Rental Rate increases are at least keeping pace with growth in MFU Sales Prices on a per-door basis, with limited supply growth and strong cash flows already in place, a positive scenario in our view. This data is sourced from Loopnet.

Ramping Crowdfunding Effort via Meetup.com Platform. Recently, Avid Realty Partners began to build out its Crowdfunding Platform. While this effort is in its early and formative days, we intend to Crowdsource deals, analysis, and capital to pursue the most attractive MFU Apartment and Hotel opportunities in the market. Join our Commercial Realty Investment Club if you would like to participate in analyzing and investing in sizable commercial realty projects. If you have a deal you would like to pursue as the Project Sponsor, reach out to us with deal specifics here.

We seek Accredited Investors and Off-Market Properties. If you are an accredited investor interested in reviewing some of our current deals, just let us know. Also, we seek attractive off-market opportunities, particularly class B and C value-add MFU Apartments in the 100-250 range unit size. If you have any such opportunities, please contact us.

Thank you for your time, and have a great rest of the week

— Craig and Dave

|

Leave A Comment