A Spooky, Silly Season is Here

A Spooky, Silly Season is Here. Thucydides really hit the nail on the head about this Election Cycle, and he lived 2500 years ago! With the 2016 Presidential Election stumbling towards the ?nish line in rare fashion, the spookiness isn’t just a Halloween thing this year. Indeed, its clear that a spooky #SillySeason is in full swing on many fronts. And not just for the Presidential Candidates, their Families, their Campaign Organizations, the PACs and Lobbyists that make their living riding the political cycles, or even for the now-frenzied Media. Indeed, it is #SillySeason at the Federal Reserve too.

Very low interest rates are driving institutional asset price bubble risks. While the Fed gave us one small rate hike early this summer (closer to half a hike), its clear that more needs to happen to slow the price momentum seen in institutional asset classes. Surely, the Fed wants to in?ate our way out of the low-GDP stag?ation seen in recent years. And while institutional assets certainly are in?ating, sometimes too much of a good thing can be bad. Everyone knows the Fed will not act right before an election, evidence be damned. Well, we now see some growing risks of an institutional asset price bubble, and we can only wonder about the cost of the #FedSittingOnItsHands much longer.

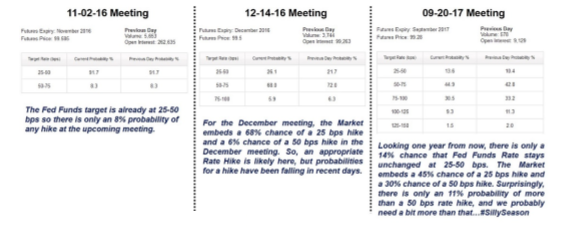

Fed Threading a needle. Given the above, it seems likely (depending on employment and other data, and the reasonableness of the various Federal Reserve Governors) that the Fed will raise rates at its upcoming December 14 meeting. And, in lockstep, Federal Funds Futures contracts are embedding a 69% probability that the Fed does raise the Federal Funds rate by at least 25 bps in mid-December (see Figure 1 below). We think that a couple of raises would do us all some good, may prevent the economy from getting ahead of itself, and could possibly extend the economy’s recovery for some time still to come. On the other hand, too many rate hikes and businesses could pull back more aggressively, and the economy could slow into a recession. So the economy does require the Fed to ‘thread the needle’. That said, at this point risks are building due to the Fed taking too little action on rate hikes. After all, economics teachings suggest that it takes at least nine full months for interest rate hikes to begin working through the broader economy.

The market expects 50 bps in hikes and done. The market collectively is only pricing in modest expectations for a raise over the next year. Indeed, only 9% of the market expects the Fed to raise rates by more than 50 bps over the next year. So two small rate hikes and we are set, says the market. Given what we know about the precarious state of the recovery, our shrinking middle class, and the lack of participation in this recovery by other market segments, perhaps two small rate hikes is all the US economy can afford for now. That said, interest rates are hovering at alltime lows and the sustainability of this faux-goldilocks interest-rate environment is highly uncertain.

Figure 1. Probability of a Hike in Fed Funds Rate at Upcoming Fed Meetings

Fed Funds Rates & 10-Year Treasuries Have a Direct Impact on MFU Apartment Cap-Rates

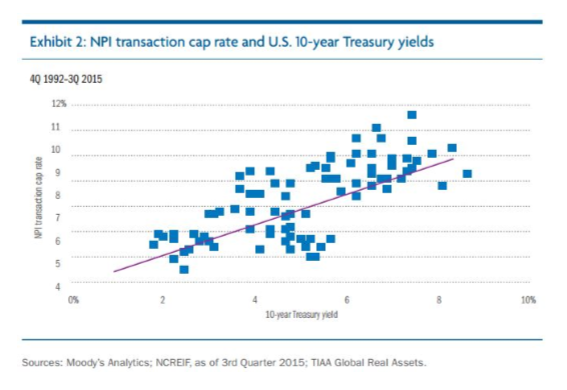

Commercial Realty Cap-Rates are directly impacted by overall interest rates; So, prices could cool as rates increase. As interest rates rise (Fed Funds rate drives the 10-year Treasuries), commercial realty capitalization rates also rise, somewhat in lockstep. See Figure 2 below. This means commercial realty asset prices could cool as Buyers’ cost of capital increases, and the prices they are willing to pay for Assets decreases to compensate.

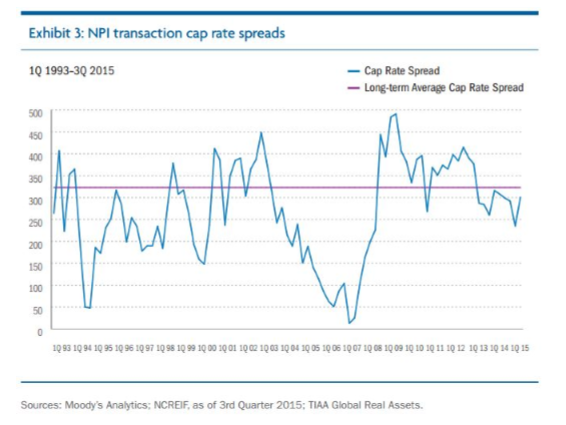

Cap-Rate versus Treasuries can Diverge over time and through cycles; CapRate spreads can range between 0-500 bps. Below we see that the actual correlation between long-term Cap-Rates and 10-year Treasuries is about 0.7. This is not a direct relationship, but is nevertheless fairly strong. Looking at Figure 3, the NPI data shows that Cap-Rates have averaged 325 bps above 10-year Treasuries. But, this spread has been as low as almost zero in the heydays of 2006-2007, and has been as high as 450-500 bps above 10-year Treasuries during economic weak periods of 2002 and 2009-2010. It is somewhat interesting that cap-rates on commercial realty assets have actually increased versus the 10-year Treasuries during periods of economic weakness, and we would guess that is due to falling net incomes at these properties (pushing up cap-rates relatively speaking). It is also interesting that the spread narrowed so much during the bubble of 2007, with today’s spread looking healthy compared to 2007.

Figure 2. Cap-Rates Often Track 10-Year Treasuries, But Divergences Occur Too

Figure 3. Cap-Rates Range From 0 to 500 bps Higher than 10-Year Treasuries

We are Risk-Protecting our Projects Through Cycles

We are Risk-Protecting our projects from softer prices and a possible economic slowdown. We are taking a variety of actions to risk protect ourselves while buying at this point in the economic cycle:

- We are buying Class B/C value-add projects where we need to roll up our sleeves to upgrade interiors, exteriors, operations, and staff oversight;

- We are buying properties with strong in-place cash flows that we will improve further in our first couple years;

- We are buying 1950s-1990s construction properties, where rents are one-half what they are in new construction apartments; If a recession comes, our properties are supply limited and some portion of Renters will downsize into our properties from newer more expensive properties.

- We are focused on buying in fast population growth zones in Central Texas, the Carolinas, the Southeast, and more;

- We underwrite all our deals assuming that Cap-Rates increase by 150 bps or more (we model our exits around 8.5%-9.0% Cap-Rates), leaving us some downside protection;

- We are very careful about not overpaying for properties, and we utilize a number of techniques to achieve this.

We intend to cash flow through cycles, buy at reasonable prices, and create value along the way through active management and renovations. Our team is willing to do the hard work to optimize these properties from both a renovations and operations perspective.

Population Growth and Demographics Matter…A Lot!

We are very focused on buying in job growth and population growth markets to enjoy long-term tailwinds. Population growth and job growth matter a lot for MFU Apartment investing, and can provide tailwinds that would not otherwise be enjoyed. Per Figure 4 below, the fastest growing cities in the US from 2010 to 2015 (with more than 750,000 people) are Austin, Raleigh, Houston, Orlando, San Antonio, Denver, Dallas, Nashville, Sarasota, and Charlotte. Four of the Top Ten are located in Texas, while Two are in Florida, and Two are in North Carolina. These are many of the markets we are focused on for growth and some value. In fact, some of our favorite markets to build our long-term presence in are San Antonio, Dallas, Raleigh, Charleston, Orlando, and Nashville.

Figure 4. Fastest Population Cities in the US from 2010 – 2015

Ramping Crowdfunding Effort via Meetup.com Platform. Recently, Avid Realty Partners began to build out it’s Crowdfunding Platform. While this effort is in its early and formative days, we intend to Crowdsource deals, analysis, and capital to pursue the most attractive MFU Apartment and Hotel opportunities in the market. Join our Commercial Realty Investment Club if you would like to participate in analyzing and investing in sizable commercial realty projects. If you have a deal you would like to pursue as the Project Sponsor, reach out to us with deal speci?cs here.

We seek Accredited Investors and Off-Market Properties. If you are an accredited investor interested in reviewing some of our current deals, just let us know. Also, we seek attractive off-market opportunities, particularly class B and C value-add MFU Apartments in the 100-250 range unit size. If you have any such opportunities please email us here.

Have a safe and spooky Halloween and Fall Season ahead.

Leave A Comment