“Whatever you can do, or dream you can, begin it. Boldness has genius, power and magic in it.”

? Johann Wolfgang von Goethe

Avid Realty Partners Closes its LatestDeal

Latest Thoughts on MFU Apartments Market: Still Frothy

From a buyer’s perspective, the market for MFU Apartments remains frothy as ever. After cooling down a touch following Trump’s presidential victory and the resulting rise in interest rates, MFU Apartment activity has again rocketed higher. We are still seeing many offers per property, 20-30 day closes, and all cash offers. Additionally, we are now seeing lower quality properties trade at low cap-rates, as higher quality properties do, which leads us to believe that if the low quality junk is trading at top dollar we might as well buy higher quality stuff. Tertiary market cap-rates have also compressed almost to the point of major markets, which again leads us to believe that if the lower quality markets are trading for top dollar we might as well buy higher quality markets. We are seeing late 1990s or early 2000s built properties in attractive markets trade at a level which produces almost ZERO cash-on-cash yield, with upside at these prices being almost entirely dependent on future appreciation. While we want to buy more MFU Apartment properties, we are concerned about deploying capital at these valuations and would need to find something considered a diamond in the rough’ to get over these many yield-challenging hurdles.

Interesting data and graphics on MFU Apartment Market. ARA Newmark recently published very interesting data on the broader MFU Apartment market. One main takeaway is that increasing new supply of MFU Apartments is causing occupancy rates to fall, concessions to rise, and will likely slow or stop the rise of rent growth. This could lead to a cooling of the cycle, though cheap money likely means MFU Apartment demand will remain among both renters and institutional money managers as long as interest rates remain low. Note, this is not our research work, and we tip our cap to the fine work seen here from ARA Newmark, Real Capital Analytics, and Axiometrics (the source of all of these graphs):

Figure 1.Asset Bubble Risks are Elevated as Cap-Rates Keep Shrinking and Prices per Door Keep Rising

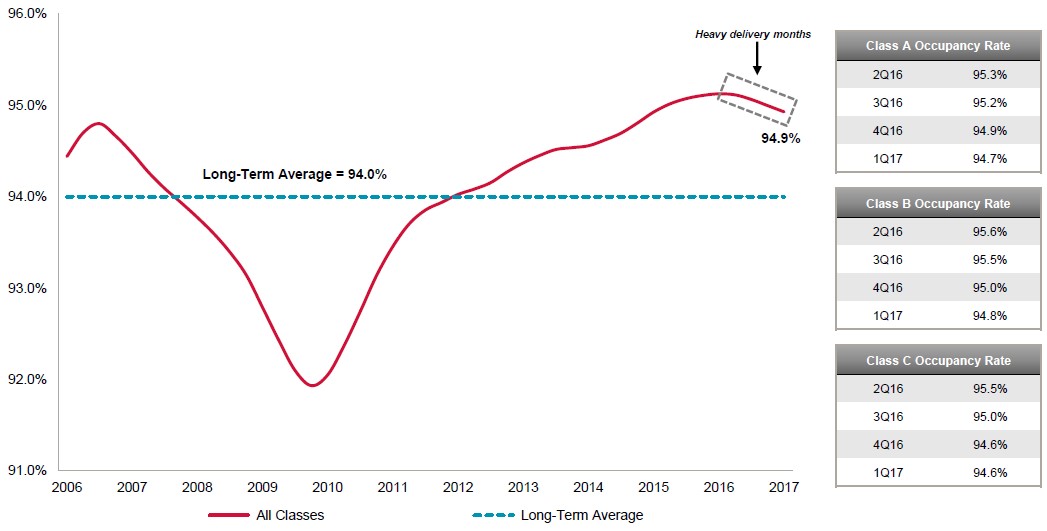

Figure 2. National Occupancy Rates Strong, But Now Falling as New Supply Ramps; Risks Remain Here

Figure 3. Rent Levels Continue to Grow, but at Reduced Rates Closer to Inflation

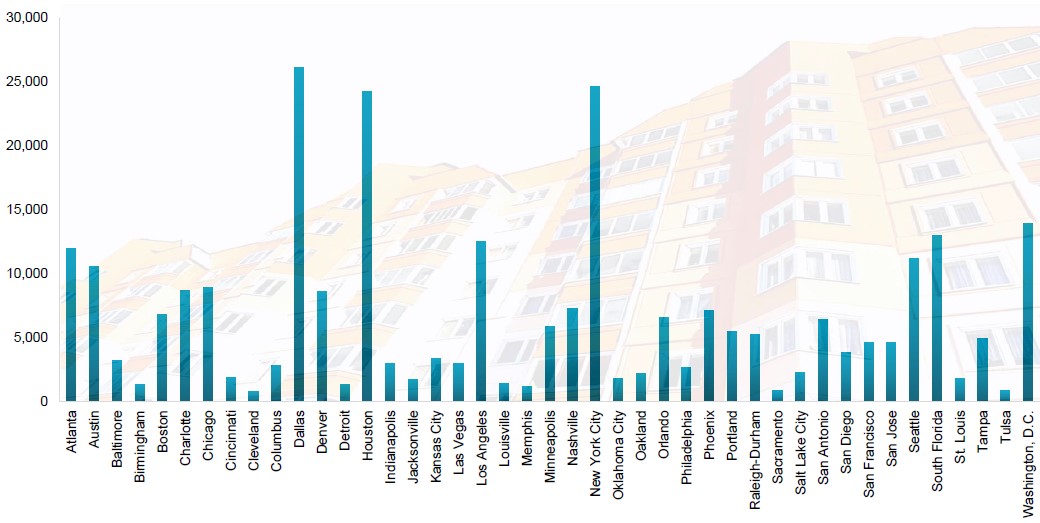

Figure 4. Most New Supply Delivery Seen in Dallas, Houston, New York City, DC, Miami, Seattle, Atlanta

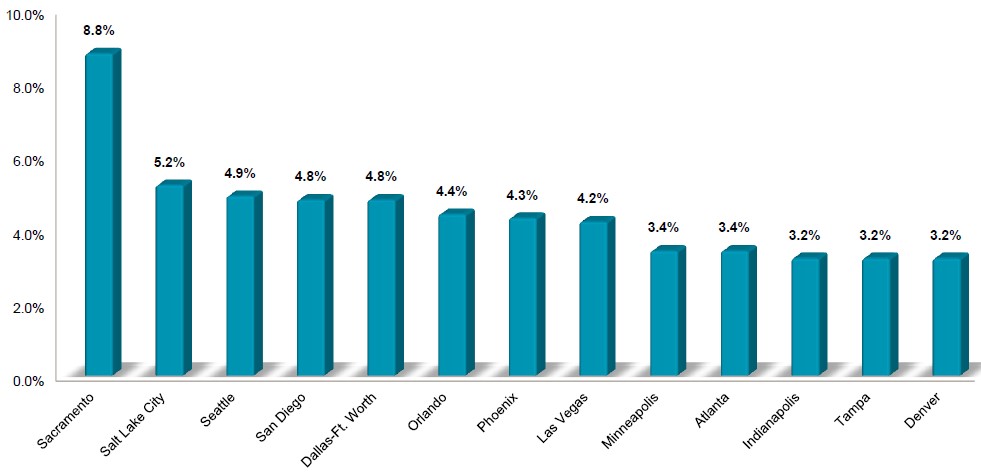

Figure 5.Rent Growth YOY: Top Markets Include Sacramento, Seattle, Dallas, Orlando, Phoenix, Las Vegas, and Atlanta, Among Others

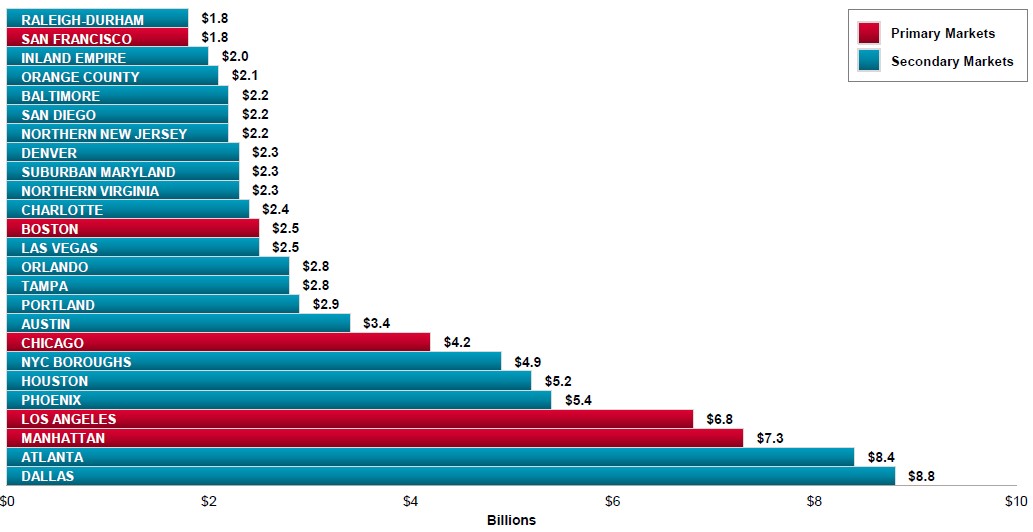

Figure 6.Atlanta and Dallas now Biggest MFU Apartment Markets in the US, Bigger than Manhattan

Latest Thoughts on Hotel & Hospitality Market

From a buyer’s perspective, the Hotels & Hospitality market is relatively more attractive than the MFU Apartments market. We hear time and again from institutional buyers and investors that they are not buying Hotels at this point in the economic cycle. In fact, we hear this so much that we think it is somewhat safer to buy Hotels at this point than it is to buy MFU Apartments. Yes, we understand there is a large supply of new, ground-up construction Hotels that will come to market in 2H17 and 2018, and that this will impact occupancy and ADR (nightly rate) trends. And we are seeing this in the MFU Apartment space too! But, given these trends we are focusing our Hospitality efforts on high population/employment growth markets, and sub-markets that are seeing limited new supply we are not buying in New York City, Miami, or sub-markets that are seeing rapid supply growth. It is also worth noting that ADR and Occupancy levels are at all-time highs, so even if national trends pull back modestly as new supply is digested, overall trends will still remain very attractive.

Financing more difficult to get in Hotels, a ‘self-protecting’ mechanism. We also observe that equity and mortgage financing for ground-up new construction hotels is much more difficult to obtain now than one or two years ago, and so the market is somewhat self-correcting’ or self-protecting’ against additional large supply increases at this point. Finally, we note that cap-rates are still significantly higher for Hotels versus MFU Apartments, even adjusting for the greater equity needed to finance hotel projects at this time. We are seeing Hotels trade at 10-12 caps for medium quality, while MFU Apartment projects are trading for 6-7-caps or so. Higher quality Hotels are trading for 8-10 caps, while higher quality MFU Apartments are trading for 5-6 caps. Net, we think there are still capital yield and appreciation opportunities to be found in Hotels more broadly versus what we see in MFU Apartments.

New Development in MFU Apartments, Student Housing, & Hotels is Increasingly Attractive vs. Buying Existing Assets

New Construction making more sense again. In scouring the landscape for opportunities, we are pivoting towards new development projects more and more. If we can buy a 40 year old MFU Apartment complex for a 5.5-cap yield to total project cost (after renovations) and we can build a brand new MFU Apartment project for a 5-cap or 6-cap yield to total project, we think it is much more attractive to pursue the ground-up construction project.

New Construction Positives & Negatives. The positives for building ground-up are that the projects are yielding as good or better than much older existing assets, we as developers end up with a brand new gorgeous and highly amenitized Property, and we can execute our Property vision rather than buying someone else’s antiquated vision. The negativesto pursuing ground-up new construction is that it takes roughly 18-24 months to get through the planning, entitlement/zoning, and construction processes, and so we experience slower uptake than buying an existing asset to operate immediately upon close of the property purchase transaction. Also, we are not into these assets at ‘below replacement cost’ the way we are when we buy older assets.

Focus on growing demographic trends. Similar to our commentary above, any new construction project — be it in MFU Apartments, Student Housing, Hotels, or other assets – needs to focus on areas where supply growth will be reasonable and population growth solid to ensure the successful absorption and uptake of the project once it finally hits the market.

We Seek Equity Partners

We are always looking for well-capitalized Equity partners to work with as Limited Partners, or even on a co-JV basis. We are open to deal structure and seek the most strategic partners that we can find as we carefully build and scale our portfolio further. We like to focus on creating tremendous Customer Experiences, realizing robust cash-on-cash yields, and managing risk at all levels of the Project and throughout our organization. Please Contact Us Here if you are interested in discussing this further.

About Avid Realty Partners

At Avid Realty Partners our passion is owning Multifamily Apartments and Hotels that deliver the best possible Customer Experience, while generating robust risk-managed returns to our investors. In Multifamily apartments, we focus on Class B/C value-add properties in growth markets around the country where we proudly bring enhanced unit upgrades and property renovations to our Residents, improving their Quality of Life metrics. In Hotels, we build or buy properties that deliver everything that our Guests deserve, and more than they expect. We are proud of the hard work and results that our Team delivers everyday on behalf of our Customers and our Investors.

Thank You for your time and attention and have a great rest of your week.

— Craig, Dallas, Dave,Erik, Mark, Paul, Rob, and the whole team at Avid Realty Partners

|

Leave A Comment