The Ultimate Long Term Gains: Saving Account vs. Real Estate Investing

If any of the following apply to you, than this webinar is for you

Investing Or Saving? Get The Answers You Need To Build Your Wealth With Real Estate

The Ultimate Long Term Gains: Saving Account vs. Real Estate Investing

Join This Live Webinar And Learn What To Do With $50K In Cash: Saving Vs. Investing Real Estate.

Join This Live Webinar And Learn What To Do With $50k In Cash: Saving Vs. Investing Real Estate.

Learn From An Experienced Industry Leader

Understand The Pro And Cons Of Saving

Unlock The Power Of Real Estate Investing

Maximize Your Returns Of Real Estate Investments

Explore The Different Types Of Investment Options

QnA: Ask Real Estate Experts

Register For Our Free Webinar

Don’t Miss Out On This Opportunity To Learn What To Do With $50K In Cash:

Saving Vs. Investing In Real Estate. Reserve Your Spot Now.

Register For Our Free Webinar

Don’t Miss Out On This Opportunity To Learn What To Do With $50K In Cash:

Saving Vs. Investing In Real Estate. Reserve Your Spot Now.

Meet The Host: Craig Berger

Meet The Host: Craig Berger

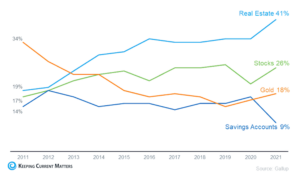

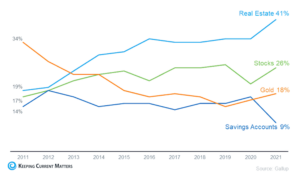

The Difference Between Saving and Investing

Saving involves setting aside money in low-risk vehicles to meet short-term goals or emergencies, while investing involves buying assets such as stocks, bonds, or invest in real estate with the aim of generating long-term growth and returns. Savings offer lower returns but more security, while Investing offer higher returns but come with more risk.

Saving

It involves depositing money in secure and easily accessible accounts.

Accounts such as checking, savings, Treasury bills, and money market accounts.

Provides capital

for investing

Investing

Has the potential to increase capital

Includes stocks, bonds, and real estate investing

Involves buying an asset in hopes of earning a return

The Difference Between Saving and Investing

Saving involves setting aside money in low-risk vehicles to meet short-term goals or emergencies, while investing involves buying assets such as stocks, bonds, or invest in real estate with the aim of generating long-term growth and returns. Savings offer lower returns but more security, while Investing offer higher returns but come with more risk.

Saving

It involves depositing money in secure and easily accessible accounts.

Accounts such as checking, savings, Treasury bills, and money market accounts.

Provides capital

for investing

Investing

Has the potential to increase capital

Includes stocks, bonds, and real estate investing

Involves buying an asset in hopes of earning a return

Saving vs. Investing: Pros and Cons

Saving offers security but minimal returns, while investing has higher potential returns but greater risks. The choice depends on your financial goals, risk tolerance, and time horizon. A diversified portfolio with both saving and investing can provide the best of both worlds.

| Pros | Cons | |

|---|---|---|

| Saving | Dollar amount in you accounts won’t decrease | Could lose purchasing power due to inflation |

| You can safely rely on reaching your goals on a set timeline if you save the proper amount | You have to save more money to reach the same goal versus earning higher returns with investments | |

| Investing | Potentially higher returns than saving | Investments could decrease in value |

| Due to higher returns, you may not have to contribute as much money to reach your goals. | You may have to delay a goal if your investments decrease in value right before you reach your goal |

100% FREE Live Webinar

Hint: It Requires $0 Investment And Only Presence On “Webinar”

Webinar Starts In…

Saving vs. Investing: Pros and Cons

Saving offers security but minimal returns, while investing has higher potential returns but greater risks. The choice depends on your financial goals, risk tolerance, and time horizon. A diversified portfolio with both saving and investing can provide the best of both worlds.

| Pros | Cons | |

|---|---|---|

| Saving | Dollar amount in you accounts won’t decrease | Could lose purchasing power due to inflation |

| You can safely rely on reaching your goals on a set timeline if you save the proper amount | You have to save more money to reach the same goal versus earning higher returns with investments | |

| Investing | Potentially higher returns than saving | Investments could decrease in value |

| Due to higher returns, you may not have to contribute as much money to reach your goals. | You may have to delay a goal if your investments decrease in value right before you reach your goal |

100% FREE Live Webinar

Hint: It Requires $0 Investment And Only 45 Minutes Of Presence On “Webinar”

Webinar Starts In…

DON’T MISS OUT – REGISTER NOW AND START GROWING YOUR WEALTH WITH $50K