You could do so much better than your bank.

Big banks should be ashamed of the interest rates they pay on savings accounts. Most offer 0.01%, or maybe 0.5% (if you’re lucky). That means for every $100 in your savings account, you earn $1 a year. What can you buy with that?

Reliably generate monthly income.

Whether you’re looking for the ease of a savings account, high yield returns with less risk, or funding your next fix-and-flip project; Avid Realty Partners’ has the product for you.

By making recurring deposits and

reinvesting your earnings, your income will

grow even faster.

How does Avid Realty Partners' compare to other investments?

Avid Realty Partners’ investments are secured by real assets in a first lien position. You can choose individual renovation projects to invest in, or use our automatic investing tools to continuously invest in projects that meet your criteria.

Investments repay every 4-12 months on average, so if you make investments each month, after four months, you’ll always have investments repaying each month. That’s pretty good liquidity for a secured investment backed by real assets! Avid Realty Partners’ is a safe way to earn great results.

Our Track Record

Zero Realized Losses, With A 33% Average Irr, Across Six Exited Deals

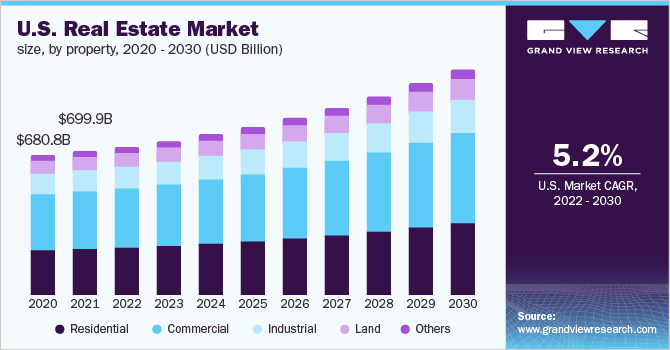

U.S. Real Estate Market

Maximize your real estate investments with Compound Annual Growth Rate (CAGR) for consistent long-term growth

Topics Covered In The Report

A Comprehensive Overview of the 2023 Market for Proactive Decision-Making

Inflation

Examining its impact on the economy, the triumphs, challenges & causes surrounding inflation.

Economic Assessment

A comprehensive analysis of the economy, including a careful evaluation of recession risks, provides insights into the current state of the economy, identifying key indicators and trends that shape its trajectory.

Job Market Challenges

The analysis aims to provide a deeper understanding of the labor market’s current state and its potential implications for individuals and the broader economy.

Housing

Landscape

Overview of the current housing situation in the U.S., examining trends, challenges, and dynamics within the real estate market.

Multifamily Real Estate Outlook

Key fundamentals, such as market trends, occupancy rates, and financing-related distress, offer insights into the dynamics, potential risks, and rewards within the multifamily real estate market.

Buying opportunities in 2023 and 2024

It identifies favorable conditions for investors providing a forward-looking perspective on the market.

Topics Included

Beyond The Surface: Deep Dive Into Value-Adding U.S Market Insights

13 Topics

Different financing options are available to passive investors looking to invest in commercial real estate, including traditional bank loans, crowdfunding, and private equity funds.

Expert Insights:

Written by industry experts, the ebook offers valuable insights and perspectives on real estate investing, helping readers make informed investment decisions.

10% Annual Interest Promissory Note

Avid Realty Partners is proud to present our latest investment product, a 10% annual interest Promissory Note paid each month in full via ACH payment right to your bank account. We are offering a term of two to five years, at your discretion. This note is perfect for people who want monthly ongoing ‘mailbox money’ cash flows without the hassle and risk of investing in the stock market, and with being locked into an illiquid real estate deal for the duration of that project. This opportunity is available to ‘Accredit Investors’ only, and verification of Accredited status will be required before proceeding.

Unsecured

One-Year Term From Execution

Accredited Investors Only

$50K Minimum Investment

10% Per Annum (Compounded Monthly)

Governed under laws of

Missouri

Funds to be used to invest in real estate or related entities

Entity is

responsible for

repayment

Why Is This Report A Must-read?

This report is a must-read for anyone seeking a comprehensive understanding of the real estate landscape. This insightful guide offers valuable insights into economic trends, recession risks, and multifamily real estate dynamics, equipping readers with the knowledge to make informed decisions. Whether you’re a seasoned investor or a newcomer to the industry, this report provides a roadmap to navigate market fluctuations, seize opportunities, and stay ahead of the curve.

- 1Inflation: Our Victory With The Three-headed Monster

- 2Revisiting The Root Causes Of Inflation

- 3Interest Rates

- 4Assessing The Economy, A Recession, & The Stock Market

- 5The Broader Economy Is Likely To See A Modest Recession And Job Losses In 2023

- 6Job Losses Are Accelerating

- 7Current Housing Situation In The U.S

- 8About The Economy

- 9Multifamily Market To See Stress, More Buying Opportunities

- 10Multifamily Apartment Market Fundamentals

- 11Occupancy Rates

- 12Financing-related Distress In The Multifamily Market.

- 13

Conclusion: Buying Opportunities In 2023 And 2024

Get started

Tell us a bit about yourself to start your investing journey with us

Testimonials

Make Informed Investment Decisions & Get a Competitive Edge

Fill Out The Form & Get Your FREE Report Now

About Avid Realty Partners

Founded by a multi-award-winning Wall Street equities analyst, Avid Realty Partners LLC (“Avid Realty”) brings high-powered analytics, risk management, and institutional sophistication to Commercial Real Estate investing. The Founder & CEO, Craig Berger, CFA CPA has been an active real estate investor for 15 years, and founded Avid Realty Partners in 2015 to deploy capital across Multifamily Apartment, Net Lease, Industrial and other assets. Avid Realty’s portfolio includes the acquisition of over 2,000 apartment and hotel doors in targeted growth markets across the US totaling over $275M of acquisition value. The firm has zero realized losses and seven full-cycle exits with a 37.0% IRR achieved (weighted by equity).

- Markets our track record since the firm’s founding in 2015

- Funnels qualified investor leads to us and our Investor Management team members

- Allows us to push out proprietary content and display our knowledge/credibility

- Engages a broader community of those who wish to invest in multifamily deals as well as sub-groups of publish our proprietary market information created by our Founder & CEO who is a former institutional Wall Street analyst for 15 years

Our Team

About Author

Craig Berger

Founder & CEO of Avid Realty Partners. Craig has been an active real estate investor for nearly 20 years and founded Avid Realty Partners in 2015 to deploy capital across Multifamily Apartments and other real estate assets. Avid Realty Partners’ portfolio includes the acquisition of more than 2,000 apartment and hotel doors in targeted growth markets across the US totaling over $275M of acquisition value. The firm has zero realized losses with a 33.0% IRR (weighted average) across six exited deals.

2023 Mid-market Outlook: Assessing The Economy, Recession, And Multifamily Real Estate

Download The Free Report & Unveil The Market Dynamics & Momentum